My Take

I was gone for a week and a war started, but the market didn’t crash. The energy sector which has lagged is now taking off, but that might not be a good thing. In order for the Fed to lower rates (which the market seems to want), the administration needs oil prices to be low. I like the UCO 0.00%↑ and SCO 0.00%↑ trades during times like these, but please understand momentum trading before trying it. Do paper trading on Savvy Trader to practice so you don’t risk money, but it’s usually a great opportunity.

And speaking of triple leveraged ETF’s, I think you can use those during times like these to your benefit. Just remember - these are NOT investments and are decaying assets so be aware. The yearly candles of QQQ 0.00%↑ and the S&P are key to understanding we can and should move higher, but short term I would consider the risk is more likely to the downside. Tariffs haven’t even been in the news cycle for a few weeks. Any dip though IMO can be bought at this point, but have a watch list of stocks where you will buy them on a dip.

🎈Father’s Day 2025: Top Financial Gifts—TrendSpider $9 Trial & Seeking Alpha Sale 💰💰 Save over $800💰💰

GET LINKS TO ALL THE SALES AND FREE THINGS FROM TRENDSPIDER UNIVERSITY HERE

✅1️⃣TrendSpider: The Ultimate Trading Edge

📅 Hurry—this exclusive deals ends TODAY!

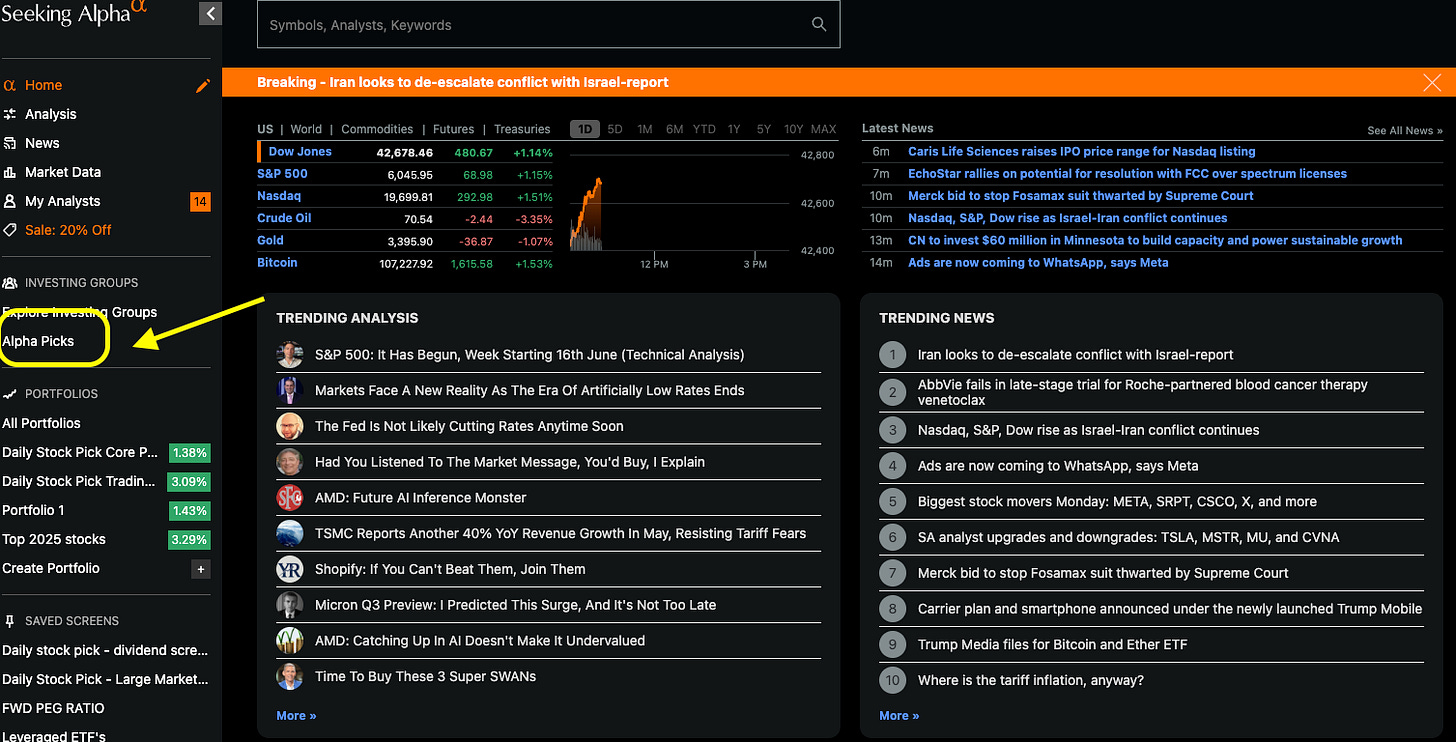

✅2️⃣Seeking Alpha: Unmatched Investment Research—Now on Sale!

For the dad who wants to make smarter investment decisions, Seeking Alpha is running its biggest sale of the year—and it won’t be back until Black Friday! For a limited time, get (click the photos to get more information on each product and discount information):

Seeking Alpha Premium: Only $239/year (was $299) with a 7-day free trial—save $60

Alpha Picks: $100 off, now $399/year (was $499) -

Premium + Alpha Picks Bundle: Just $638/year (was $798)—save $160

Seeking Alpha Premium unlocks unlimited access to expert articles, powerful screeners, and proprietary stock ratings that have consistently outperformed the market. Alpha Picks, their top stock-picking service, has delivered returns of over +150% since inception—making this a gift that could pay for itself with just one good idea.

📅 Hurry—these exclusive Seeking Alpha deals end July 4, 2025!

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Monday

US Open Golf - what a PUTT!! ⛳⛳

Did you watch the us open?? That was an amazing final round

📈Set a reminder for 12pm - New Alpha Pick Stock

Today you get a new alpha pick at 12pm. Remember - you can pull up the Alpha Picks portion of the website, refresh at 12pm and then trade on a 1 min candle if it’s a small cap stock to scalp.

🆓Tomorrow’s Big Top 2nd Half of 2025 Stocks event - ATTEND IT WITH A FREE 7 DAY TRIAL OF SEEKING ALPHA

And don’t forget - you can get a free 7 day trial for Seeking Alpha Premium and get the top stocks for the 2nd half of 2025

🛢️The War and energy trade

The Iran Israel conflict is a risk- if there is an escalation that includes energy targets - that’s the issue - so far that hasn’t happened and it’s probably because Trump would get involved then.

Last week we had a major escalation in the mid east that spiked oil prices. Let’s look at $uco and $sco trends but realize that’s how the Trump administration was selling a Fed cut was the right path.

🍼 Fed Meeting - will they cut?

Tuesday is the fed meeting with the announcement on Wednesday. Expect the market to peak but so far nobody expects a cut right now

Yearly Charts show you should be buying

At this point, I want to look at yearly candles though.

QQQ

$SPX goes back to the 1970’s

Getting set for this week - Catalyst Watch

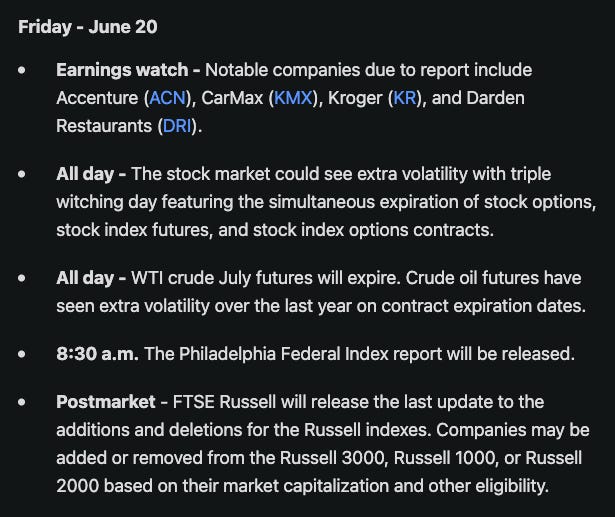

If you want a day by day blow of things going on - here’s the catalyst watch article that is a weekly one to follow if you have seeking alpha. It’s my fav one to read over the weekend to get ready for the week. This weekend I didn’t have time to do anything so I read it this morning and got ready for this whole podcast in 3-5 minutes. I didn’t even know the market is closed on Thursday for Juneteenth. If we get an escalation this week of wars, expect this holiday to be rolled back.

Friday is interesting

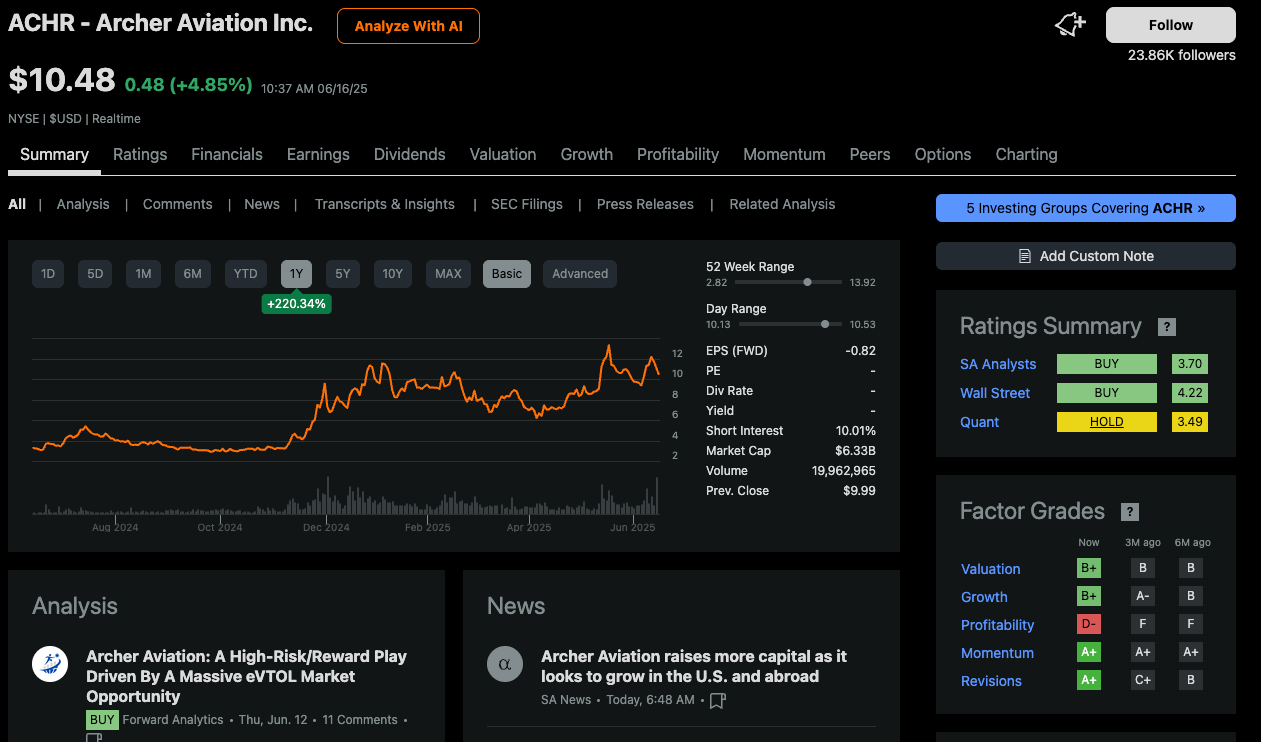

YOLO Trade - flying cars

Last week you had Trump signing an executive order for flying cars in the us …. Here’s $achr which is an example of a yolo trade. If I were in my 20s I would buy and hold something yolo like this but in my 40s and 50s I really prefer trading things like this.

Core Portfolio Stocks that are currently a BUY in the 4 hour algorithm

DIS

LLY

PLTR

TSLA

TSM

XOM

👀 A few stocks in the Watch List

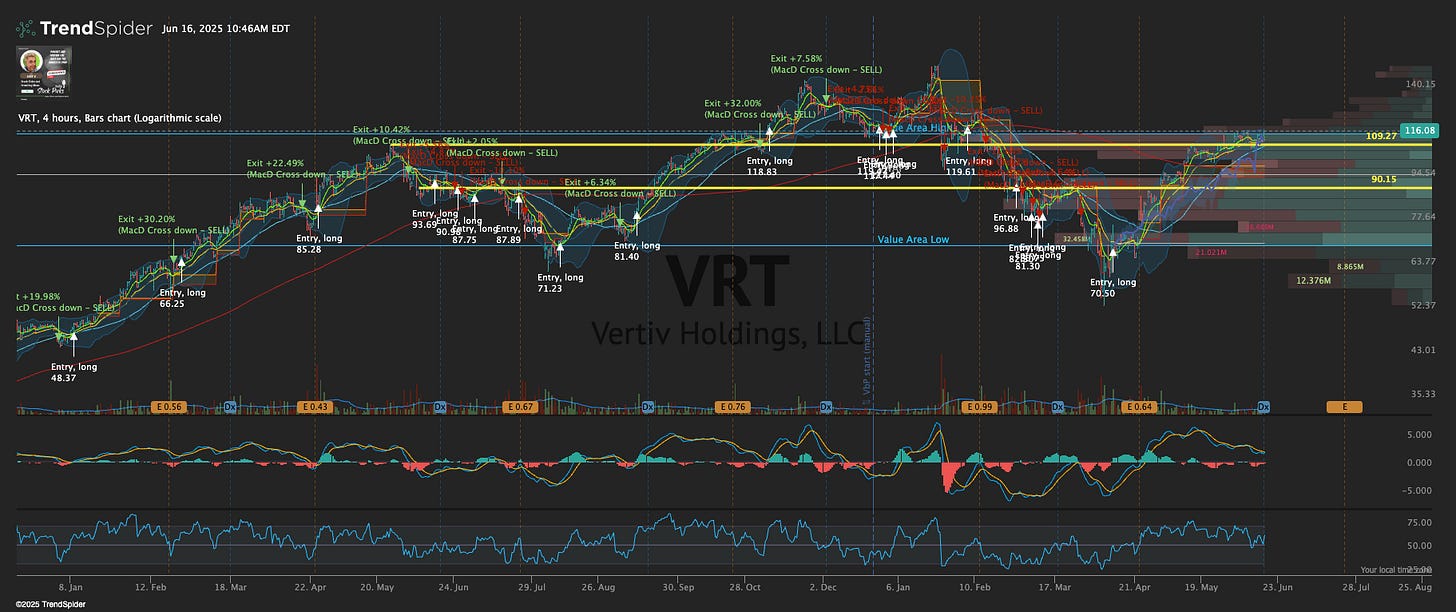

$VRT - came right back up to a previous all time high at $110

$AMD is breaking out from it’s low at $91 and may run back to that $164 price

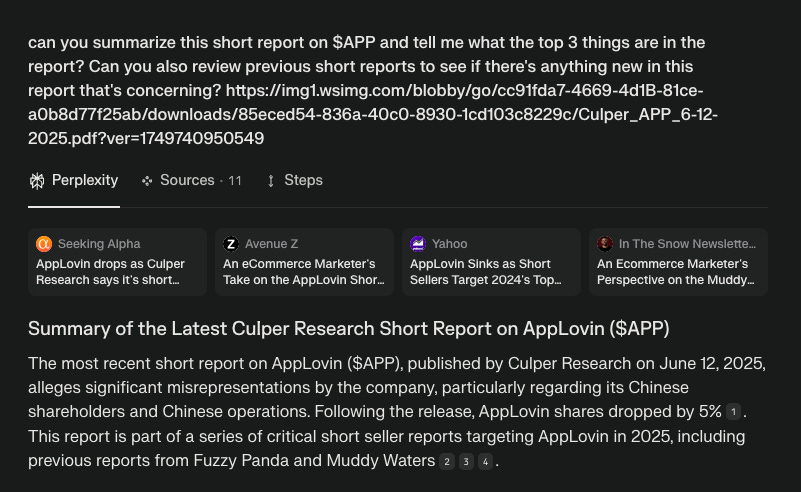

$APP had another short report - we’ve seen how this works out.

If you’re concerned - ask AI about it and then go back and compare how the other short reports affected the stock.

$CLS is breaking out again as a top 2025 stock

$TTD got you out of the 4 hour algorithm trade, but I still think that gap up there looks juicy - my dad currently owns a bit of this, but we have NOT traded it effectively

$CRWD got up to $491 - reported earnings and then you could have bought it back at $440. I did buy a few shares as it pulled back because I cut half my shares at $440 before earnings. So I bought back in slightly higher to rebuild my position.

$ETHE just got you out of a 50% trade

SCANS - Entries in the 4 hour algorithm in the Daily Stock Pick Watch List

CELH

PRMB

VST

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.