My Take

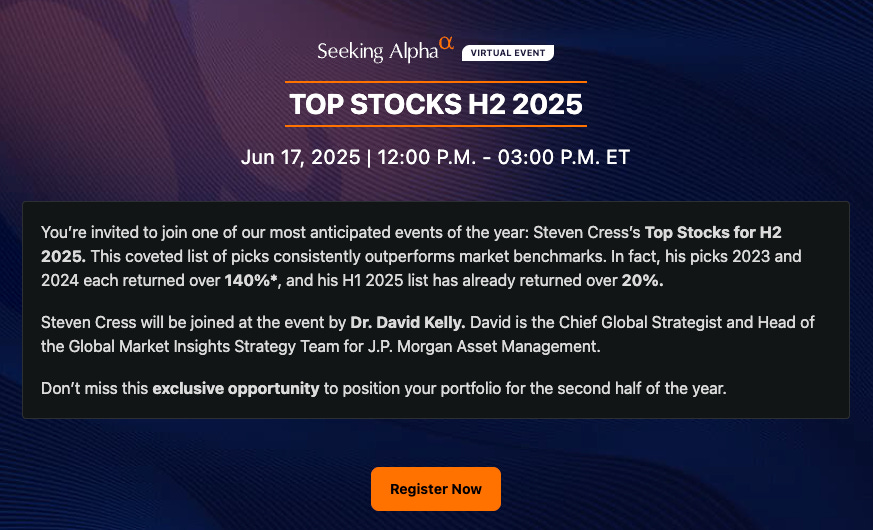

There are certain “themes” that I like - AI, GP1, Mag7, etc. There are also certain strategies I like - ONES THAT WORK! So when I find a strategy that has worked, I want to copy it or follow it. The Top 10 stocks for 2023 and 2024 worked SO well that it was a no brainer the top stocks for 2025 was likely to outperform and they are. I’ve gone over them many times on the podcast, but Steve Cress just put out a summary of the performance and it’s a master piece.

What’s even more important is he announced an event on June 17th for the Top 2nd Half 10 stocks. Let me guess one that will be included - Credo ( CRDO 0.00%↑ ). But you don’t want to miss this event as the buying of these stocks very likely will increase the price of them if they have small enough market caps.

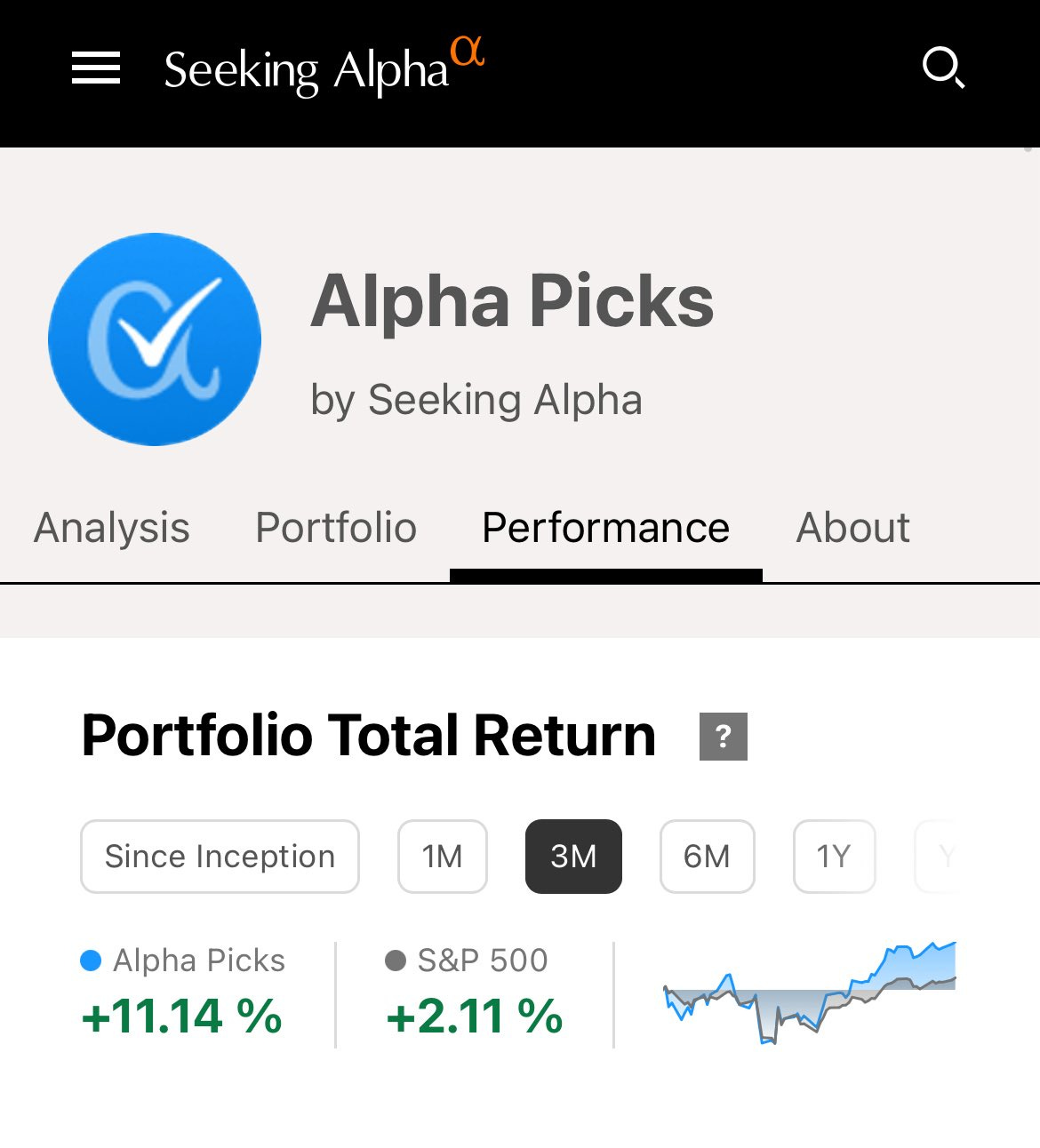

Then you have the Alpha Picks Portfolio which over the last 3 months is up an incredible 11.4%. My portfolio is NOT up this much at all, but I do have almost $150k in the Alpha Picks portfolio which equates to $16,500 in gains I would NOT have had if I did not hold this portfolio. Most likely that $150k would have been in VOO 0.00%↑ or QQQ 0.00%↑ which over 3 months have NOT gained 11%.

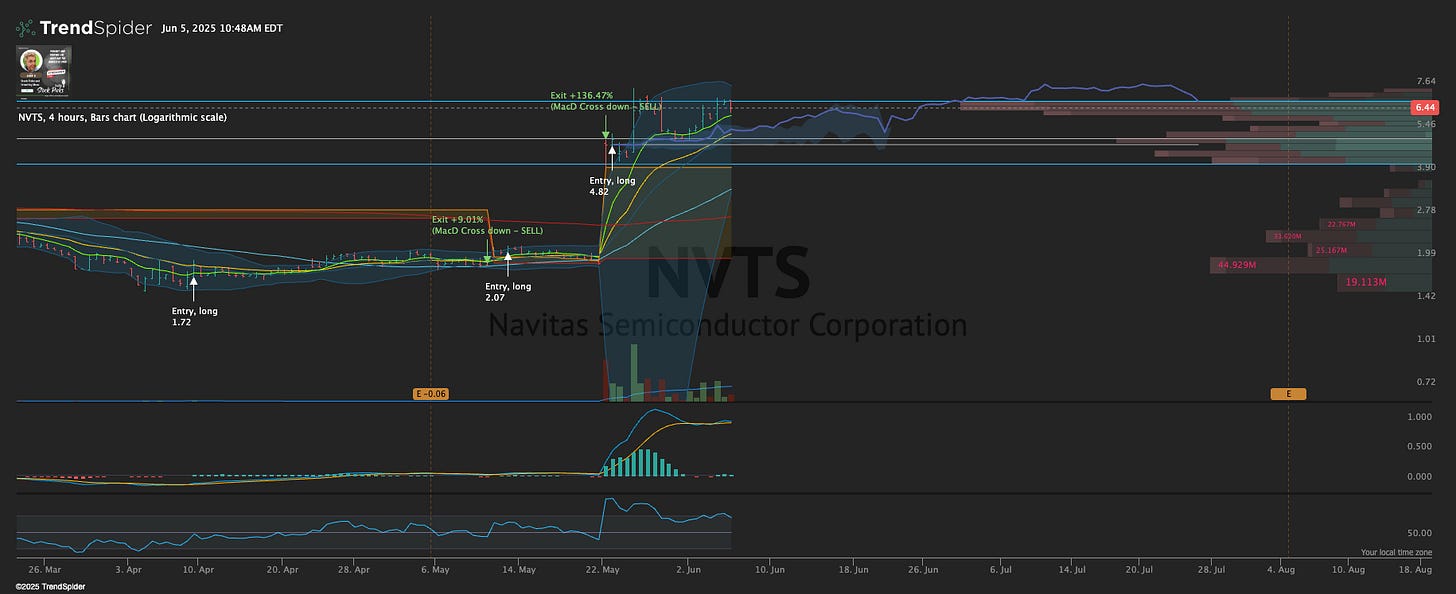

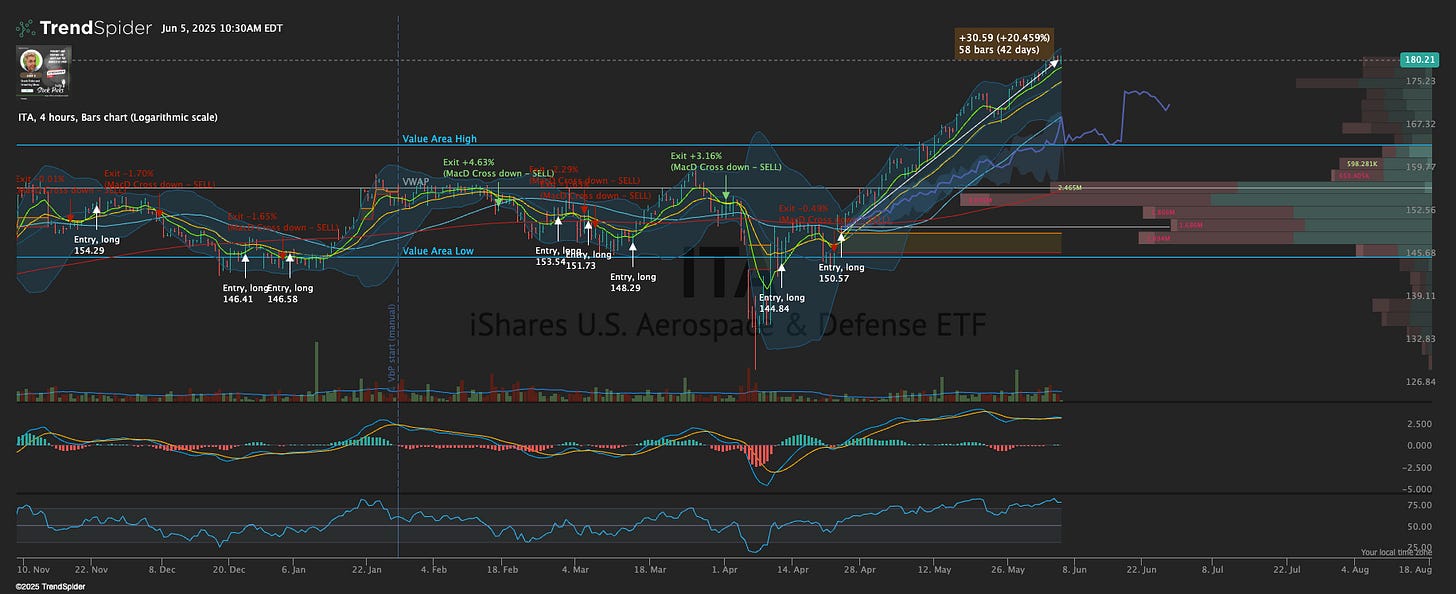

My point is I have a mixture of strategies in my portfolio. I do hold VOO 0.00%↑ and QQQ 0.00%↑ and other ETF’s and stocks, but I’ve chosen to also go with strategies that work. It’s why I like my 4 hour algorithm in Trendspider. On many of the stocks I hold, I’ve developed strategies that have WORKED for me. Strategies are hard to come by, but if you can find one that’s back tested, it greatly increases the likelihood of future success. It’s never guaranteed and being nimble and able to adjust is always important - but a strong base of backtesting the performance is what I tend to prefer.

Get Webull for your YOLO trades

When the dip happens, you’ll want to take some big swings in a YOLO portfolio, so have your watch list available and get your Webull trading account ready to make some big swings in this market to get back to all time highs.

The Tools I use to be more efficient and save time

1. Trendspider

Click on this link for savings and more details, but once you sign up for an annual plan, just contact me to get all the tools that I use like my 4 hour algorithm, custom watch lists and scanners.

2. Seeking Alpha Bundle (Premium and Alpha Picks) - save over $150

Get both Seeking Alpha Premium and Alpha Picks together and save over $150. Both these services are described below. Click the link for more details.

3. Seeking Alpha (FREE 7 DAY trial and SAVE $30 MORE)

Find top Quant stocks and ETF’s by getting Seeking Alpha Premium and a FREE 7 day trial. I use this constantly to find opportunities between the Quant, AI analysis, my portfolios, the analysis and even the TOP STOCKS.

4. Get Alpha Picks - it beats the S&P

And if you want to see how I set up the portfolio, here’s the YouTube video you can watch.

Remember the Gary Bundle

The optimum bundle that I can’t live without is:

Trendspider - or some type of chart program that works for you.

Seeking Alpha Bundle that includes Premium (which is the Quant rating for thousands of stocks and the NEW Virtual Analyst Reports that make it easy to understand fundamentals ) and the Alpha Picks portfolio that is a data driven portfolio with a performance that almost triples the S&P.

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Thursday

Alpha Picks is outperforming the market

Alpha picks performance ytd - 1 month 3 month and since inception nearly doubling the S&P performance. A portfolio of stocks that have a history. The portfolio not only picks stocks - it has shown me a rules based approach that has made me a better investor in managing my own portfolio. 💼

Top 2025 stocks

Lets point out that not only is alpha picks outperforming the market ytd - but so are the top 10 2025 stocks and Steve cress just posted the summary article as to why and how he’s had 3 years of picking 10 stocks at the beginning of the year that have outperformed the S&P by a large margin

So if you have the Seeking Alpha Bundle - you’re on your way to paying for that subscription if you haven’t already just with these 2 portions of your portfolio. Add in some yolo stuff that I’ve thrown out based on seeking alphas quant and you’re doing better than my own personal portfolio which is down.

Mag 7 are not doing as well as the 2 portfolios above

Let’s look at MAGS 0.00%↑

Top 2025 Stocks for the 2nd half EVENT

And the event on June 17th is another don’t miss event to buy the stocks that may outperform in the 2nd half of the year

Leveraged ETF’s - SOXL 0.00%↑ - an overview

And if you’re interested in triple leveraged ETFs like $soxl - read this article - it goes over everything about the etf and how it’s not a buy and hold tool

Something different for Seeking Alpha subscribers - go and watch this alternative ETFs webinar. These are the ones that pay crazy dividends and seeking alpha has a screener - this was interesting

Jobs didn’t crash the market

Jobs number - 255k was the key - it came in below - market didn’t care.

Jobs are the issue and now we’re seeing some manufacturing jobs being at risk - they may be saying tariffs - but let’s be real - this may be robotics too

The S&P is in a bull market

Just looking at Finviz - there were 50 of the S&P 500 that hit new highs and none hit new lows yesterday. BULL MARKET. 257 of the S&P 500 though is still trading UNDER the 200 day moving average. 155 are below the 50 day moving average

Trendspider continues to kill it with these custom scanners and tools - 3 bar play - GO AND GOOGLE IT

Want a reason to try out Trendspider? Try now the swing detector that’s completely scannable now

Big IPO today - Stable Coin - Circle $CRCL

Circle IPO - overpriced - yes - tradeable - yes

Robotaxi’s in Austin - not automatically a winner

Before you think $tsla is an automatic with robo taxi it’s important to think about the failures of $uber and $gm who both shut down operations after a public incident

And the April trend line has been broken

And the 4 hour algorithm has you out of the trade with a nice gain.

And don’t give up on $uber

The Robots are coming 🤖

Want a list of robotics stocks and details why each is a buy? Here’s an article with all the details

Spotify ( SPOT 0.00%↑ ) is such a great stock

I do own $spot in my Webull account

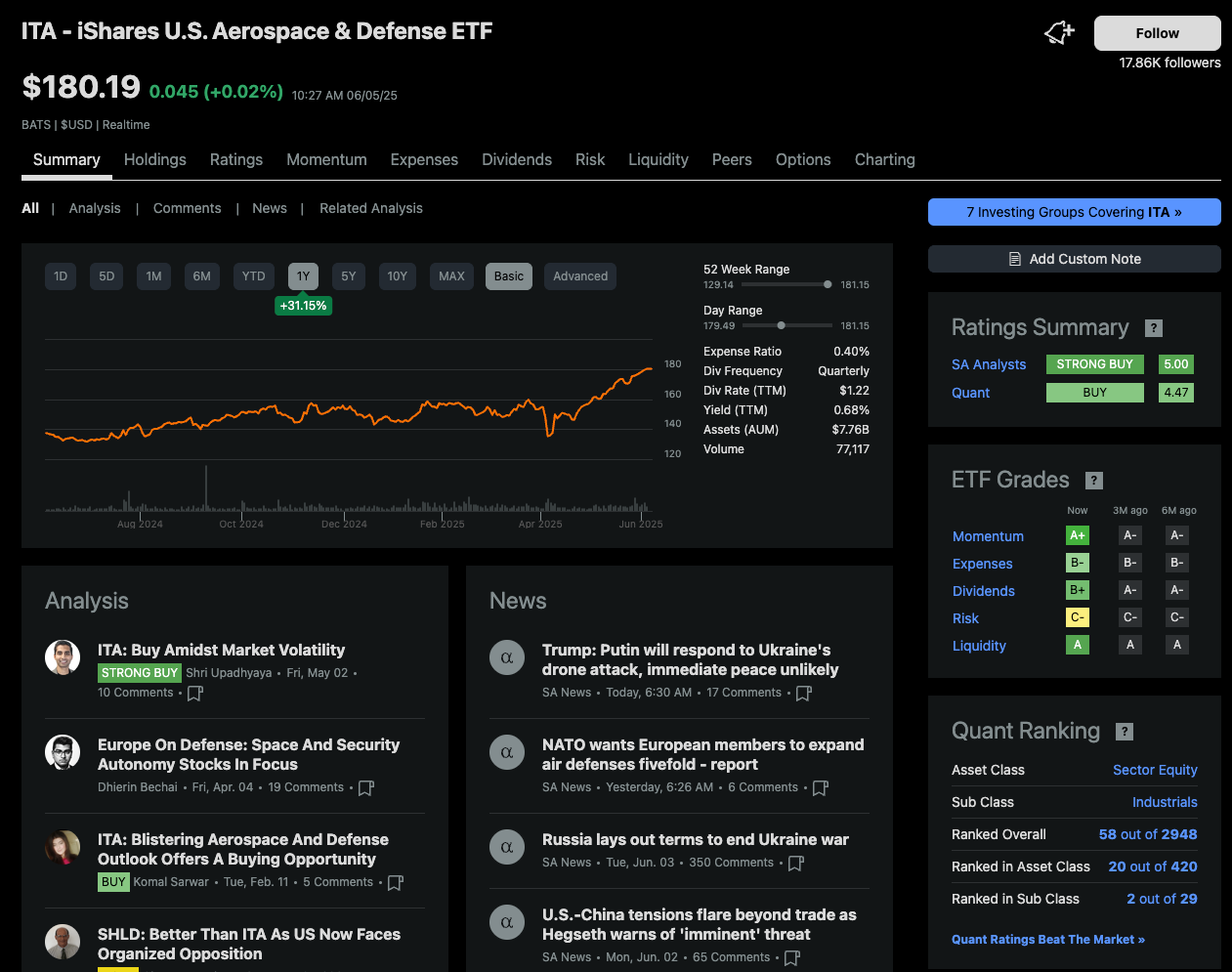

Defense and Industrial stocks are WINNING

$ita an etf around defense hit an all time high yesterday

It’s an AI market - here’s 30 AI names in a new ETF ranked by the Seeking Alpha Analysts

And if you’re looking for an ai etf - here are the 30 names held by $ives ranked in order

Stocks to be added to the S&P tomorrow - which ones?

The S&P will announce new entries tomorrow … $hood and $app may see real pops

Retail Traders are selling the rips in the Mag 7

But what are retail traders trading? Not the mag7

Earnings

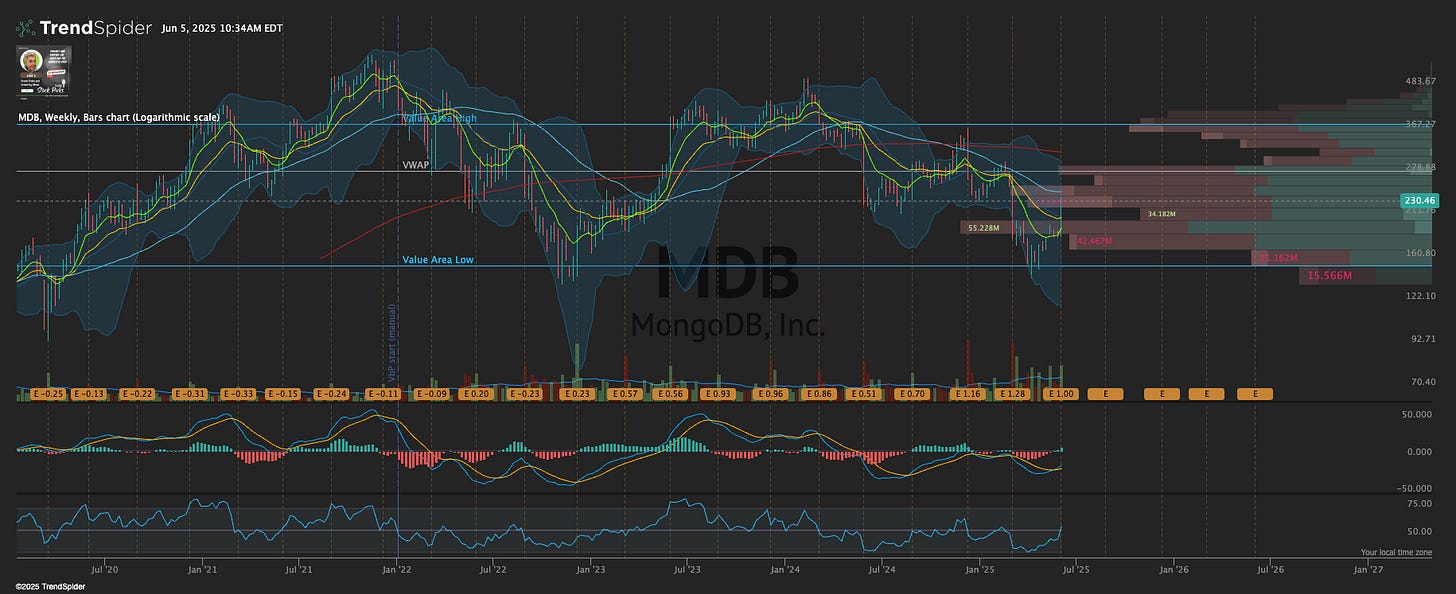

MDB 0.00%↑ killed it … up 15% … it’s a strong sell in the quant so it shows you the quant is not 100% just like every tool

Tonight you have AVGO 0.00%↑ - I went over why I’m not sure I would be buying here.

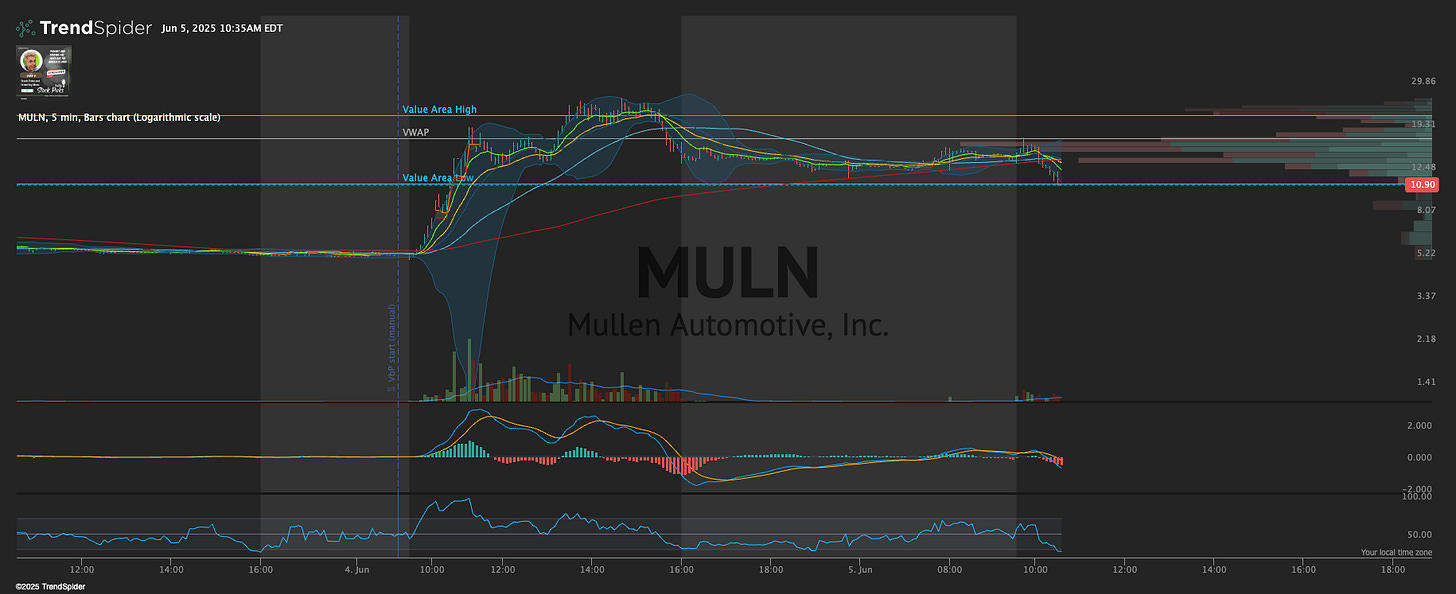

Yolo Trade

MULN 0.00%↑ is a stock I’ve traded in the past and it took off yesterday … these are ones that if you learn how to trade a chart - they can be quite lucrative so you want to set up a watch list of them and alerts - it’s more about being organized and having the tools that allow you to determine the move

Coreweave ( CRWV 0.00%↑ ) is just crazy

CRWV 0.00%↑ is just a short squeeze on a good business …. APLD 0.00%↑ continued its crazy move as well

If I were to buy a data center stock - it would be this

I stay bullish on NBIS 0.00%↑ which is the same business- data centers

Another great stock that Shay is holding - NVTS 0.00%↑

Up 239% over 1 month - here’s a break and retest - moving to all time highs again - $nvts - this is the one shay won’t sell

Fire tip Friday on a Thursday

An HSA is the best savings hack ever - if you can afford to leave the money in there - do it - just save the receipt. There is no statute of limitations on when the money has to come out so pay the expense and let the money compound.

We live in a time where if you don’t know what something means - it’s VERY simple to get a specific answer and have a conversation about it

And to finish off - here is what I learned today. I saw this tweet from JC

I then screen shot it and asked perplexity to explain it

There is NO reason anyone should say “I don’t know what that means” today.

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.