My Take

While I’m still thinking the market is range bound, even tariff news isn’t taking the market down. Dollar General reported earnings this morning that were good and guided higher while saying tariffs will cause fluctuation in their guidance and the market didn’t care taking the stock up 10%. The Atlanta GDP estimate was raised yesterday and today we get the administration having a Wednesday deadline to other countries to submit proposals for tariff negotiations. It’s all adding up to the market being very resilient. If I see an opportunity, I will take it. This feels very much like last year when Apple had WWDC come up and stocks were all hyped up on AI and then the bottom fell out in mid July. If that happens, I’ve still got some dry powder on the sidelines that’s currently earning 4.13% in FZDXX.

5 Key Investing Lessons from the first 5 months of 2025 to Help Me Beat the S&P in the last 7 months

Where did I come up with this list?

Get Webull for your YOLO trades

When the dip happens, you’ll want to take some big swings in a YOLO portfolio, so have your watch list available and get your Webull trading account ready to make some big swings in this market to get back to all time highs.

The Tools I use to be more efficient and save time

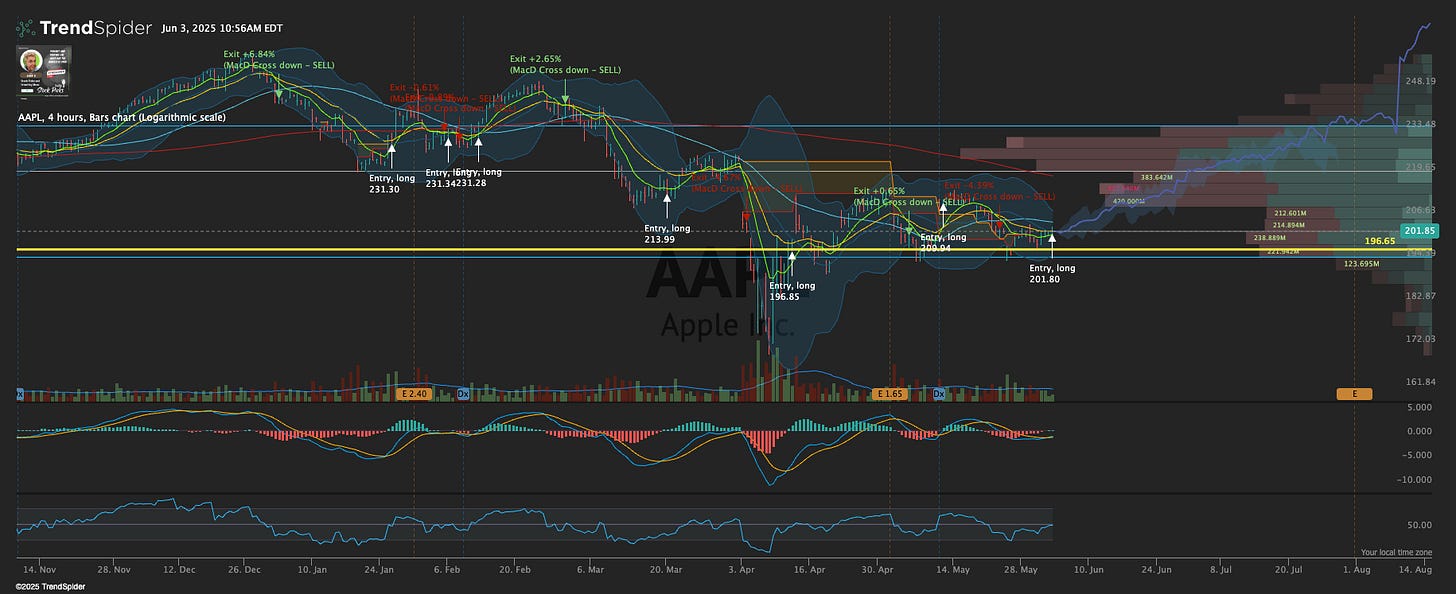

1. Trendspider

Click on this link for savings and more details, but once you sign up for an annual plan, just contact me to get all the tools that I use like my 4 hour algorithm, custom watch lists and scanners.

2. Seeking Alpha Bundle (Premium and Alpha Picks) - save over $150

Get both Seeking Alpha Premium and Alpha Picks together and save over $150. Both these services are described below. Click the link for more details.

3. Seeking Alpha (FREE 7 DAY trial and SAVE $30 MORE)

Find top Quant stocks and ETF’s by getting Seeking Alpha Premium and a FREE 7 day trial. I use this constantly to find opportunities between the Quant, AI analysis, my portfolios, the analysis and even the TOP STOCKS.

4. Get Alpha Picks - it beats the S&P

And if you want to see how I set up the portfolio, here’s the YouTube video you can watch.

Remember the Gary Bundle

The optimum bundle that I can’t live without is:

Trendspider - or some type of chart program that works for you.

Seeking Alpha Bundle that includes Premium (which is the Quant rating for thousands of stocks and the NEW Virtual Analyst Reports that make it easy to understand fundamentals ) and the Alpha Picks portfolio that is a data driven portfolio with a performance that almost triples the S&P.

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Tuesday

Congratulations - you’ll likely be better off than most

First I want to commend everyone for listening to this podcast because I read a great quote yesterday.

If you think investing is scary - imagine being broke in retirement.

That hit home - the hope is I’ll give you enough information and tools to help make sure that your decisions won’t make you broke in retirement.

Theme Song background and AI is changing

Second I don’t know if everyone knows but the theme song was done using ai. The ai I used is being sued but now it seems they might actually be going in with all of the studios

Charts at the end of the newsletter - are they useful?

Did you see all the charts I posted yesterday in the “scans” section? Those are all stocks with a bullish entry in the 4 hour algo. If you like those and look at them, comment on the newsletter. If they aren’t needed - I won’t publish them.

New Alpha Pick yesterday - Top 2025 Stock

New Alpha Pick - it’s a top 2025 stock pick from January and let’s look at how those are doing.

Jobs Report on Thursday could be key

Why should you watch the jobs report this week on Thursday? If initial jobless claims is over 255k - he’s predicting market craziness with fear and a Fed rate cut to counter job weakness

Jobs Market may be the domino

And layoffs may be coming this summer as they continue so it’s an important metric to watch as the Fed has seen lower inflation but they believe tariffs will add to inflation so the jobs market will be the key to them cutting

Tariffs remain in the news

I saw some reports that Chinese tariffs were paused until Aug 31 - this may push us even higher now - but Trump is pushing forward - the courts can’t stop him at all so any rally based on court decisions - I’m going to use leveraged ETFs

Energy is the new gold

Energy was the biggest gaining sector yesterday with $XLE gaining over 1%. So what stocks gained?

And remember - energy is the new gold - so look at what happens when energy companies get deals for ai - $ceg is up 15% - all nuclear $OKLO $SMR $VST $LEU

My Scanner for PEG ratio and finding new life with AppLovin ( APP 0.00%↑ )

I have a scanner in Seeking Alpha to look at forward PEG ratio and it came up with 5 stocks

$APP is a new add to this one - it’s still a strong buy in the quant as it has been since $370 back in 5/19. Even better the 4 hour algorithm got you in on April 23 at $234. If you’re going to chase this - you could have literally made back your subscription fee on either of these tools by investing in this stock. Learn on the free tools but perfect your game with the paid tools.

Tariff Negotiations - Boeing ( BA 0.00%↑ ) and Cheniere ( LNG 0.00%↑ )

Remember how I mentioned $BA would be used to pressure countries instead of tariffs? Well that was when $BA was trading at $160 - don’t say I never give you actionable advice. And just look at the 4 hour algorithm on this stock.

HIMS - I should have held it - it’s a grower (see what I did there 🍆)

$HIMS surges as it acquires ZAVA - HUGE - goodness I should have kept this one

Stock up 50% in 1 day - is it a buy? APLD 0.00%↑

$APLD - which I got a question about a few weeks ago and I mentioned it was “risky” went in BIG with $CRWV and BOOM - 50% gains yesterday - $7B in revenue with a $1.5B market cap? That seems like the fundamentals will change for $APLD

But since its spread out over many years - it might be worth selling the hype and waiting to see the execution - kudos to

on this analysis!On the other hand - Coreweave ( CRWV 0.00%↑ ) may be a good one if they don’t have to dilute to pay for growth

$crwv might need to be looked at .. I hate IPOs but omfg this article with the thought they won’t dilute shareholders - they will issue bonds based on stable cash flow

Other Stocks NBIS 0.00%↑ HOOD 0.00%↑ LMND 0.00%↑ TSLA 0.00%↑

One that’s been on my watch list -$nbis - down on a bond offering …. Watch it for these pullbacks

$hood just hasn’t pulled back at all - kudos to

on the leveraged ETF win.$LMND is one that I used to trade during 2020 quite a bit - is it now moving back to a loved stock? It’s AI insurance

$TSLA - if this happens - expect $TSLA to be at $500/share

Education

Tori trades ONLY on Trend lines - do I suggest that? NO - but trend lines are an AMAZING tool to determine when you should get in to a stock. The 1 thing I know about trend lines is - it must touch at least 3 points - the more points - the more legit the trend line is. Here is her lesson COMPLETELY

And this is a trader who simply does the “Break and retest” strategy

So what is this strategy???? HERE YOU GO!!! This is the way you learn! Go and have a further conversation with AI and have them look for charts that have a break and retest. Go and see if you can scan for it using your scanner - TRENDSPIDER HAS A SCANNER

I used the Trendspider scanner and found $BCS - USE THE TOOLS YOU HAVE!

Earnings

$crdo killed it - that now makes $nvda beat - $amd beat and we have $avgo on Thursday - expect them to beat and very likely going back to all time highs which now is only like $3 away

Pelosi wins again

And the chip market is growing so find which ones you like or get an etf - this article offers an analyst giving his ideas on which chips he likes

And $DG went crazy with great earnings and guidance - they said tariffs may impact this year but they took a bold step in raising guidance …. The market believed them

One last degenerate thing - use your home equity to buy Bitcoin

And ending with another degenerate bitcoin idea … taking your home equity and turning it in to bitcoin

SCANS - these are stocks that show a bullish entry in the 4 hour algorithm in Trendspider - get an annual subscription to Trendspider and set alerts for the stocks in your portfolio like I do

AAPL

BRK.B

CLF

META

MPLX

PLTR

RBLX

XOM

XLU

V

DASH

ORLY

ABT

COP

MA

NEE

RTX

Watch List

AVGO

BA

BROS

DAY

DOCU

META

MNDY

PLTR

SKYW

SNOW

SOFI

Leveraged ETFs

AAPU

AAPX

COMB

FBL

METU

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.