My Take - Why are people not interested?

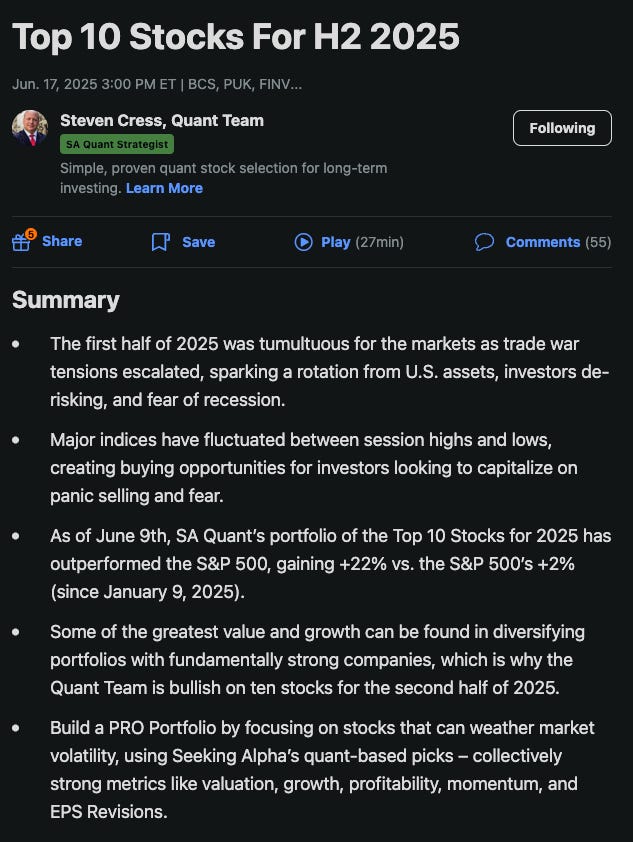

When babies are younger, they are spoon fed. As children grow, they feed themselves. I feel like providing a FREE 7 day trial for ALL readers to get the Top 2nd Half 2025 stocks is literally spoon feeding everyone. There’s NO reason not to do this. I have my strategy set on how to enter, but just like the Top 2025 stocks announced in January, I will own these through the end of the year.

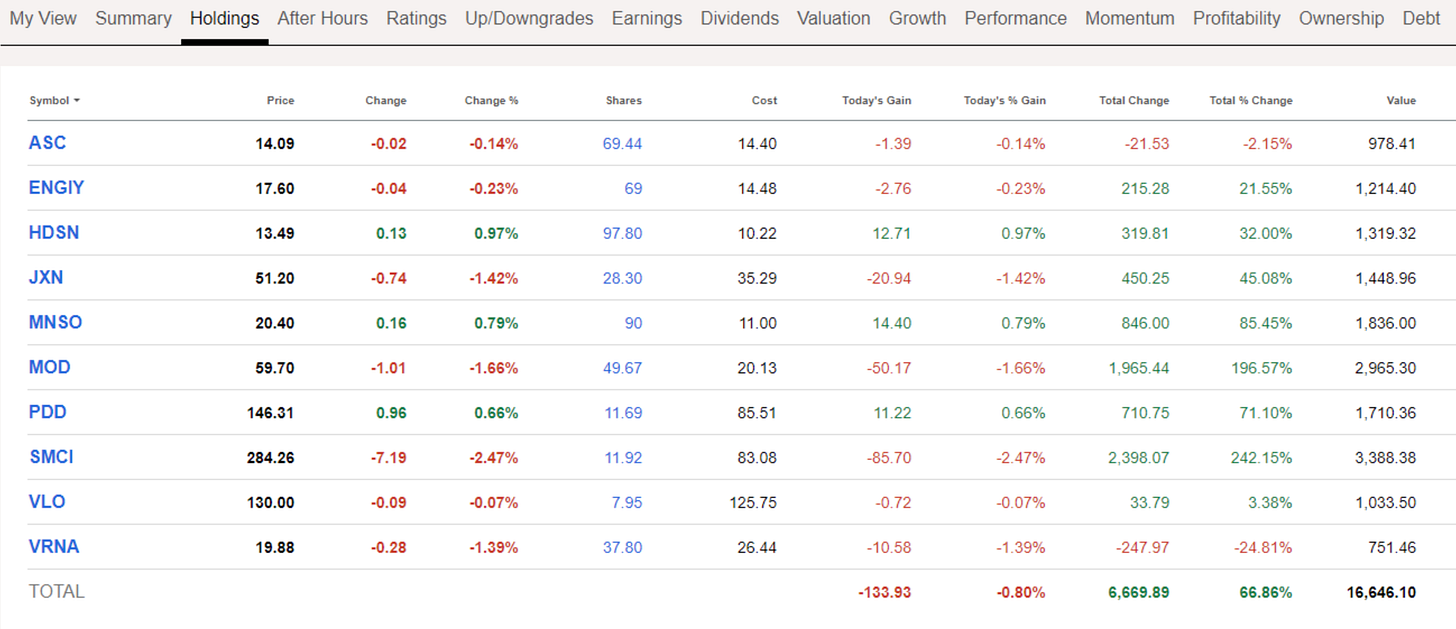

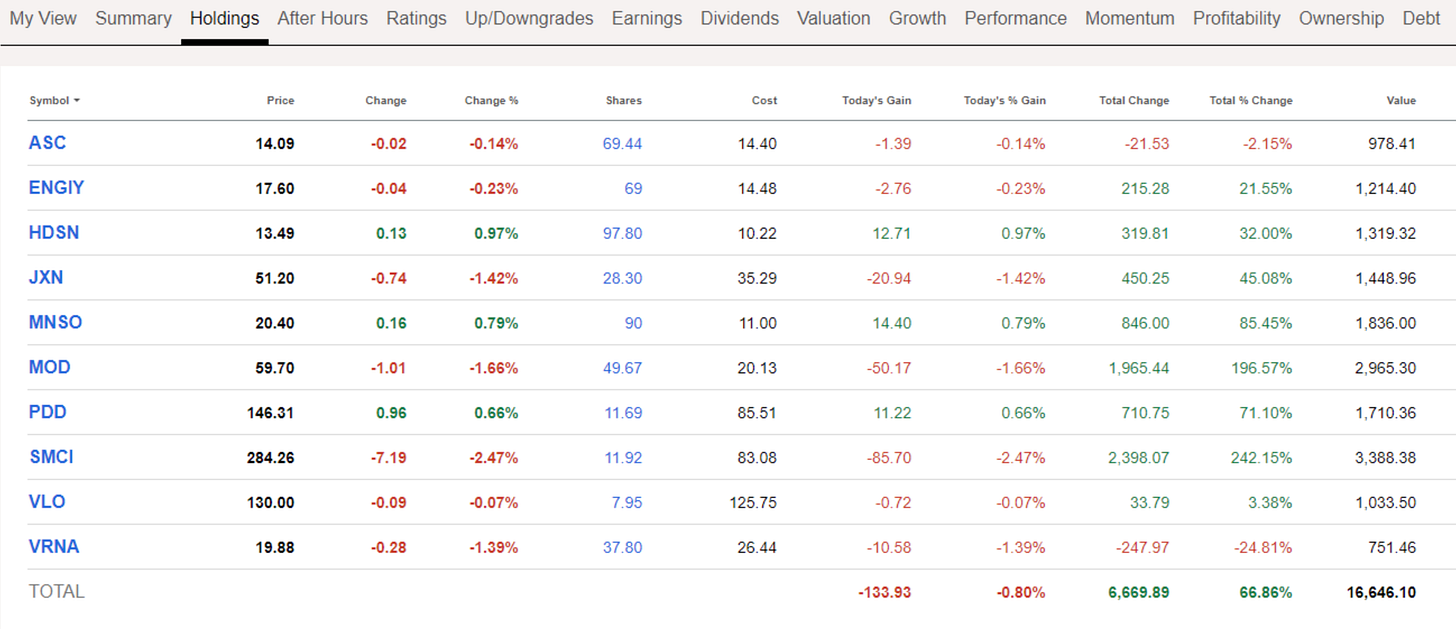

Here’s the YTD performance of those stocks picked in January (remember - the S&P is up 2.3% YTD).

Here are the Top 2024 stocks with their performance over 1 year from Jan 2024 to December 2024.

And here’s the performance of the 2023 Top Stocks during that calendar year.

I have thousands of readers of this newsletter every day and EVERYONE has the same opportunity. You can cancel during the 7 day trial and own these stocks and hopefully they outperform again.

✅Seeking Alpha: Unmatched Investment Research—Now on Sale! - 3 choices - Premium, Alpha Picks or The Bundle - all on SALE!

Seeking Alpha is running its biggest sale of the year—and it won’t be back until Black Friday! For a limited time, get (click the photos to get more information on each product and discount information):

Seeking Alpha Premium: Only $239/year (was $299) with a 7-day free trial—save $60

Alpha Picks: $100 off, now $399/year (was $499) -

Premium + Alpha Picks Bundle: Just $638/year (was $798)—save $160

Seeking Alpha Premium unlocks unlimited access to expert articles, powerful screeners, and proprietary stock ratings that have consistently outperformed the market. Alpha Picks, their top stock-picking service, has delivered returns of over +150% since inception—making this a gift that could pay for itself with just one good idea.

📅 Hurry—these exclusive Seeking Alpha deals end July 4, 2025!

✅TrendSpider: The Ultimate Trading Edge

Unlock user-friendly, automated charting tools that make it easy to spot trends, support/resistance, and patterns—even if you’re new to technical analysis or haven’t used charts much before. I show how these features can transform your investing confidence, just as they did for me.

Access live market scans and smart watchlists to discover new trade ideas in real-time, helping you find opportunities you might otherwise miss—no advanced charting skills required. I demonstrate these features daily, making it simple for everyday investors to follow along and learn.

Learn and grow with built-in backtesting and educational resources: test strategies with decades of historical data, and join a supportive community to accelerate your charting and investing skills.

Enjoy exclusive bonuses when signing up with my link, such as custom algorithms, watchlists, and personal support—so you can start making smarter investment decisions from day one, even if you’re just getting started with charts.

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Wednesday

Top 10 Stocks Event - I have a watch list and portfolio built

Top 10 stocks event from seeking alpha - did you buy them? Get a free 7 day trial and go and listen to the event and buy them

You’ve seen 2025 so far as I showed them earlier in the week, but here’s 2024

And 2023

I created a portfolio and a watch list for myself with alerts to enter on a few that I didn’t buy.

Be ready - have a list of 5 stocks

Remember in this market - make a list of 5 stocks you will buy on any pullback no questions asked - this could be your list.

The Top Stocks have been mentioned on my podcast, but many non subscribers probably didn’t buy them

What’s funny about these stocks is I’ve mentioned 1 in the last day as an alternative to $oscr, 1 is a stock I mentioned last year as a top stock when it was $4 and it’s now at $53 and most of the others have all been mentioned on this podcast. The non subscribers of seeking alpha probably just haven’t bought any of them because the research tools of other platforms don’t include the quant rating that has been back tested to outperform the market. Like this $IBIT ratings downgrade for $IBIT. Has bitcoin run enough now? Maybe - profit taking at $60 may be a strategy as it was down 4% yesterday.

WW3 couldn’t bring down this market

Why do you want that list? Because you’re in a market where Friday there might have been the start of world war 3 and did the market crash? Nope …. That’s shows the strength of the buyers who are buying the dip and it’s going to take a major catalyst to take this market down.

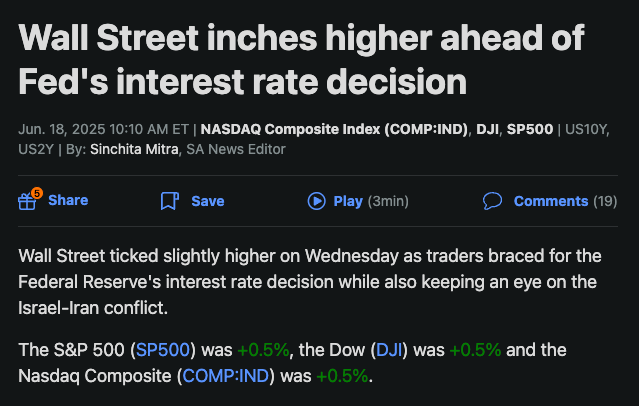

Fed decision today at 2pm and press conference at 2:30pm

🍕What information can you use? Pizza? 🍕

And do you want to help predict a crisis? Pizza orders are the key!

If you want to follow the account - here it is

Exactly mid way through 2025 - here are the leaders

Sectors hitting all time highs ( XLK 0.00%↑ )

And $XLK hit an all time high yesterday - crazy 25% move in just 60 days for an index. If you hear about tariffs or chip exports - expect this to pull back but this is a big ETF in my portfolio

This has outperformed the S&P in 3, 5 and 10 years, but over 1 year it’s under performed.

And don’t forget about financials with deregulation and easing of rules in the 2nd half of this year.

I own $BAC $WFC $GS currently

🕯️Candlesticks - Weekly

Monday I looked at yearly candles which showed how crazy a bull market the last 18 years has been. Tuesday we looked at the monthly candles that showed it’s still a crazy upward trend. Now today let’s look at weekly candles on $qqq and $spx to see what the current trend looks like.

It’s an AI market for SURE

The ai engineers are getting crazy money now and why I like META

I really should have gotten AMD 0.00%↑ under $100

$MSFT and $AMD - BOOM

Defense Stocks and the Anduril IPO

I brought up archer aviation ( ACHR 0.00%↑ ) the other day. ACHR was a stock that Shay brought up on a space yesterday that was tied to Palmer Luckey Anduril which is going to be a HUGE IPO

I just went on Finviz and there’s not 1 Defense company in the S&P trading below it’s 50 day moving average

Only LMT and TXT are below the 200 day moving average

$MRVL - interesting play

Education

A stock that’s up 59000% this year - has no sales and only 12 employees - would you invest in this one?

We talk about over valued but the market sometimes looks past it. Here

gives you an analysis of $pltr and the history of how it seemed over valued even at $20Scans - Stocks that are bullish in the 4 hour algorithm in Trendspider

CLF

PANW - Over $200 as I said when I bought the dip at $180

COIN

DDOG

DELL

S

SCHW

FTNT

DE

LMT

Leveraged ETFS

CONL

SARK

TMF

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.