My Take

I’ll say it now - I think we get back to all time highs again this year. Is it this month? I don’t think so, but it could happen. Momentum has started to change drastically and money is coming back in to the markets in a big way.

The end of today’s episode I go over “buy the dip” and how I view that topic through the valuation of a stock. There are plenty of different explanations, but why should you buy NViDIA now vs. back in 2023? Because it’s actually cheaper. It doesn’t ALWAYS work that way, but my views of the market has always been - let me find good companies with good products with good profits and good management and I’ll be able to either trade around a position or just sit on the stock to outperform the market. That’s why I like Alpha Picks as a rules based portfolio. They explain every move they make in the portfolio and why it has worked and maybe why it hasn’t. It’s why I like researching stocks in Seeking Alpha (like I do with Heritage Insurance - HRTG 0.00%↑ today) and why I like looking at charts for opportunities in Trendspider (like I do with We Ride WRD 0.00%↑ today). There’s always a way to make money in the market, but it’s more about trying to limit the risk and that needs to be customized to your own risk tolerance.

And should anyone want to see the my retirement analysis results - it’s posted on Twitter. I posted it as part of a FIRE (Financial Independence Retire Early) discussion I had on Spaces yesterday and I would rather not post it again here. It’s personal and not something I ever would share - but rest assured - I do not have $43M in stocks today. The Monte Carlo simulation just estimates the growth over the next 36 years.

I think it’s clear we’re in a bull market, so have your watch list available and get your Webull trading account ready to make some big swings in this market to get back to all time highs.

The Tools I use to be more efficient and save time

1. Trendspider

Click on this link for savings and more details, but once you sign up for an annual plan, just contact me to get all the tools that I use like my 4 hour algorithm, custom watch lists and scanners.

2. Seeking Alpha Bundle (Premium and Alpha Picks) - save over $150

Get both Seeking Alpha Premium and Alpha Picks together and save over $150. Both these services are described below. Click the link for more details.

3. Seeking Alpha (FREE 7 DAY trial and SAVE $30 MORE)

Find top Quant stocks and ETF’s by getting Seeking Alpha Premium and a FREE 7 day trial. I use this constantly to find opportunities between the Quant, AI analysis, my portfolios, the analysis and even the TOP STOCKS.

4. Get Alpha Picks - it beats the S&P

And if you want to see how I set up the portfolio, here’s the YouTube video you can watch.

Remember the Gary Bundle

The optimum bundle that I can’t live without is:

Trendspider - or some type of chart program that works for you.

Seeking Alpha Bundle that includes Premium (which is the Quant rating for thousands of stocks and the NEW Virtual Analyst Reports that make it easy to understand fundamentals ) and the Alpha Picks portfolio that is a data driven portfolio with a performance that almost triples the S&P.

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Tuesday

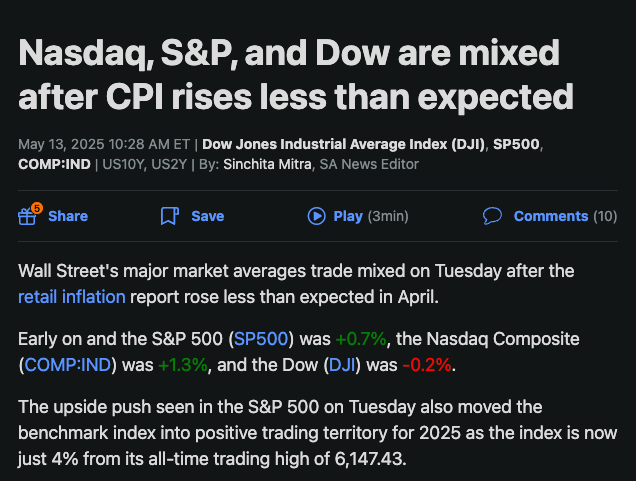

CPI in April - GOOD NEWS - Expect a Fed cut in June

Retirement Planning - DO IT

I logged in to Fidelity yesterday to see front page. The biggest % gainers in my account were Alpha Picks

Then I used the Fidelity retirement tool yesterday to tell me how I’m doing. It tells me that I will die at 90 years old with $43M in the bank. Yes I’m wealthy - but I don’t have $43M today - that’s tomorrow’s dollars. Wanna know why? Because I’m invested. Because I’ve got risk. If you haven’t run a Monte Carlo model on your retirement or if your brokerage doesn’t have one, GET IT DONE!

Timing the Market - Cramer is the key

Now if you’re looking for when the market bottomed … it was when Jim Cramer scares everyone saying black Monday was coming and the market should be prepared for much more downside … I watched this day

Back to All Time Highs?

I also agree with Ryan here … I think momentum is strong, trade deals are looking good and I think the 2nd half of the year with the one big bill - it’s going to push back to all time highs which aren’t far off

And we are seeing the S&P targets being raised and recession risk minimize - we may already be in a recession though and this is the recovery

And since we’re in a “buy the dip” market … here are some stats

Alpha Picks

Alpha Picks sold a stock yesterday because it had a Quant rating of a HOLD for 180. It did make the portfolio 37% since June 15, 2023 but look at how many stocks have taken off since then. It’s a software company with an elevated valuation suggesting it’s no longer a GARP - which is what Alpha Picks focuses on.

Since its inception, the Alpha Picks Portfolio Total Return has delivered an impressive +146.01% versus the S&P 500’s +49.49%, with seven out of 37 Alpha Picks returning more than 100%.

And it was pointed out to me I brought up $hrtg as it was a top stock last week and a few audience members bought it just to test out seeking alpha before actually subscribing to the service - they paid for their yearly service with that trade …. Several subscribed because of that.

So get both premium and alpha picks and save over $150 and start using the tools to find opportunities and learn about managing a portfolio that beats the S&P

Trendspider - Warrior Trading Scanner and Political Buys

And I had a meeting with Trendspider yesterday who created a mock up of Ross Cameron’s warrior trading stock scanner for anyone to import in to their Trendspider setup.

If you don’t have Trendspider - go and try it out for $20 - import this scanner and then try and trade a momentum stock

And while you’re in Trendspider - just a reminder - you can add political buy alerts like this one.

Marjorie Taylor Green bought this - but you can also buy it $RH is going to fill this gap.

Stock Opportunities

$coin will replace $discover in the S&P

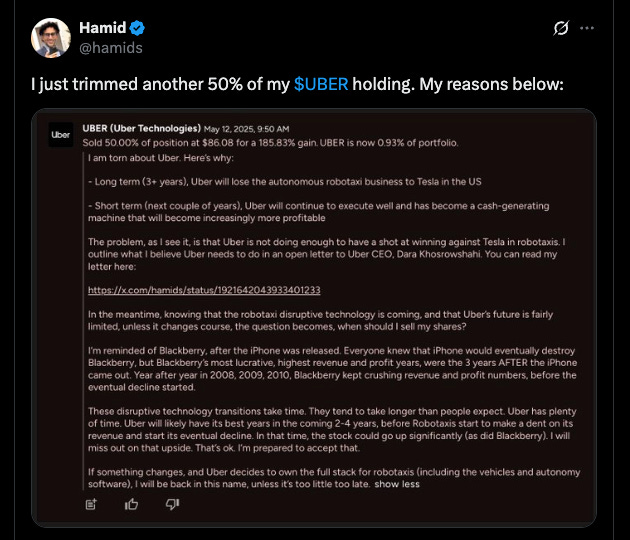

$UBER hit an all time high and the ceo of earnings hub and savvy trader just sold 50% of his position and took profits … I can’t argue with these reasons at all

$PLTR continues to run

$TSLA joins the $1T club now

And it very likely will continue to grow

And then you have this

$nvda I think is going to push back to $140 and may break through … the valuation is just staggeringly low compared to its growth … and they announced a $5b write down already … and remember yesterday when I said a chip deal with the saudis is coming?

$AMZN was one of the bigger winners - I don’t think this is done.

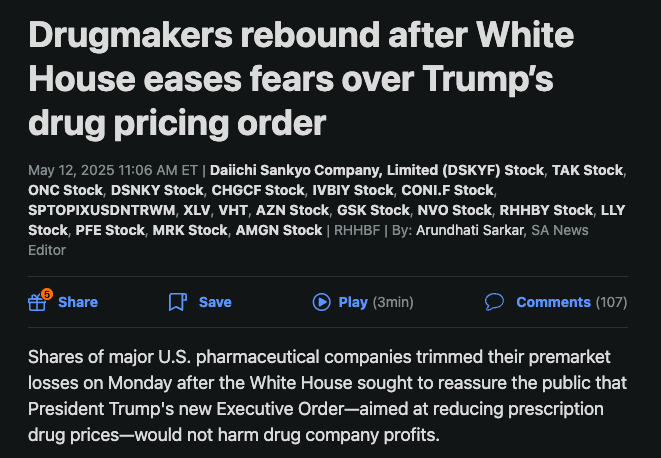

$LLY actually rebounded yesterday

But it’s def in the cross hairs of this administration

$ibit - remember bitcoin?

1 hour stock battle - $WRD

$GCT is back in an uptrend - this stock can fly as it has done.

Core Portfolio update - UNH is a mess

And I’ll address a HUGE mistake in the Core Portfolio. $UNH - it’s been a CRAZY fall from grace. I took it out after the Luigi incident saying it had bigger issues - it then turned around and was doing well - I added it back in. It since then has had horrible earnings, more drama and now - the CEO departs and they pull guidance. At this point - suck up the loss - it’s out!

$TTD - gap fill - I have alerts set - do you?

Social Requests

I will respond to most - not necessarily on the show - but mostly comments. The reason is I get so many sometimes, it would be a show in its own. But Jon asked one where it might be confusing about “BUY THE DIP”. How? There’s no science to it really. Look at PE.

It all comes with risk - you can buy the dip in things like $CSCO in 2000 or $GE in 2000 and it wouldn’t work out.

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.