My Take

We are clearly in a bull market and participants don’t believe the Middle East tension matter at this point. The market is looking towards moving past the July 9th tariffs and I believe it’s now pricing in a July rate cut (instead of September).

Overall the market is STILL expensive and the weekend Compound podcast went over how the Mag 7 ( MAGS 0.00%↑ ) has underperformed the market YTD. I believe there are still opportunities in this market if you just create a thesis around them and I take you through a couple today:

Cybersecurity - yes they are expensive - but this may be the next war that is fought and these are the tools on the front line.

HIMS ( HIMS 0.00%↑ ) - any reaction is an over reaction so I’m going to find an entry to trade it using a double leveraged ETF since it’s a trade.

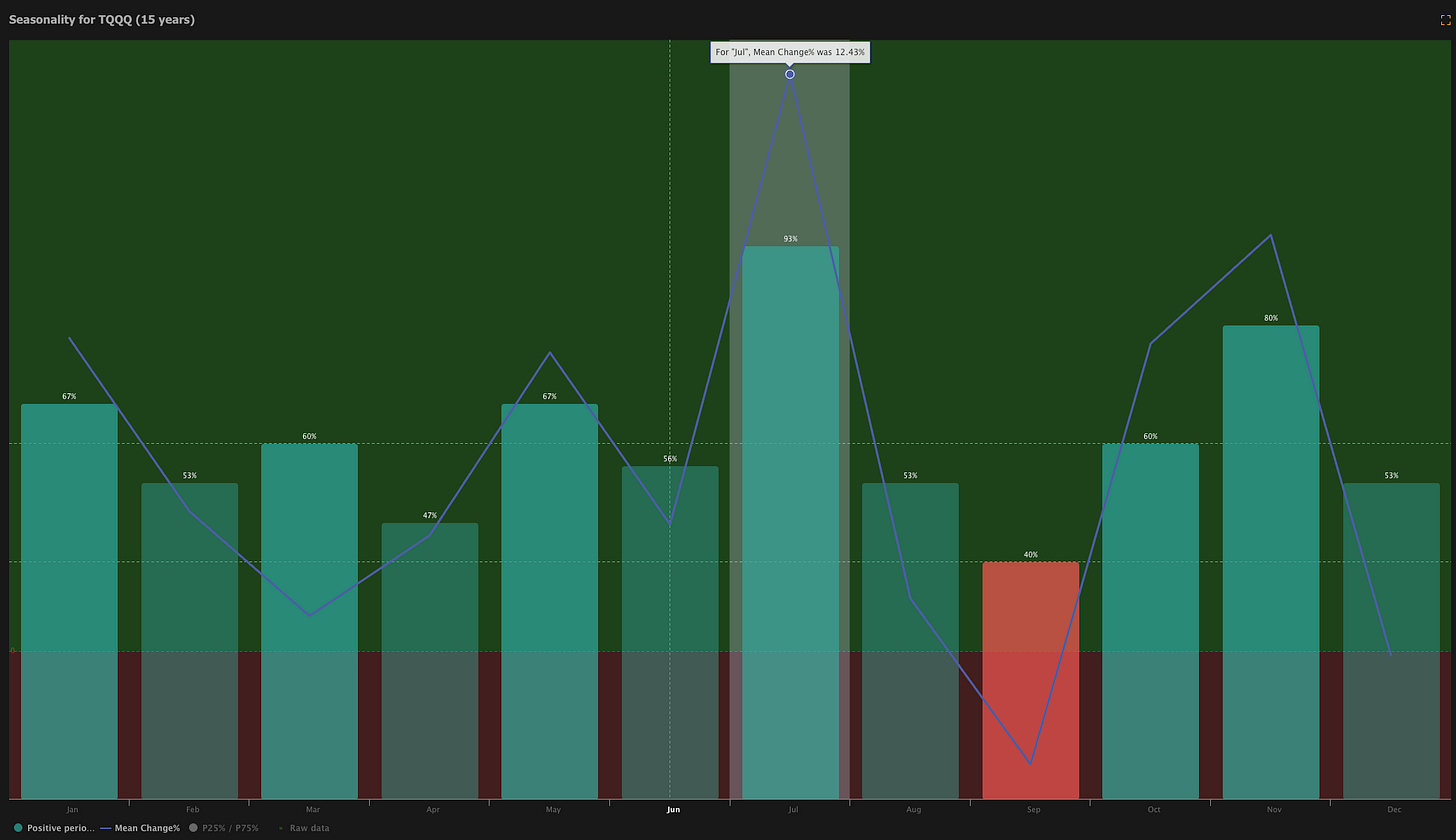

Seasonality - QQQ 0.00%↑ has a HUGE July - how should you trade it?

Deregulation and Regional Banks - DPST 0.00%↑ has a solid back test and an entry today. Time to trade it?

PLUS - a bonus podcast below with a Tesla ( TSLA 0.00%↑ ) strategy on how I’m looking to enter this trade. I use charts

BONUS PODCAST - 🚀 Tesla $TSLA Trade Alert: My Idea! 💡📈

📊 Backed with charts, 📅 seasonal data, and 🚦 major catalysts coming up.

🚀 Don’t miss this breakdown—let’s ride the next Tesla wave! 🌊⚡️

WIN A YEAR OF TRENDSPIDER

If you’re subscribed to this newsletter (not just a follower, but the newsletter shows up in your EMAIL inbox), you’re entered to win. The drawing will be on July 4th. Just make sure you’re subscribed.

✅Seeking Alpha: Unmatched Investment Research—Now on Sale! - 3 choices - Premium, Alpha Picks or The Bundle - all on SALE!

Seeking Alpha is running its biggest sale of the year—and it won’t be back until Black Friday! For a limited time, get (click the photos to get more information on each product and discount information):

Seeking Alpha Premium: Only $239/year (was $299) with a 7-day free trial—save $60

Alpha Picks: $100 off, now $399/year (was $499) -

Premium + Alpha Picks Bundle: Just $638/year (was $798)—save $160

Seeking Alpha Premium unlocks unlimited access to expert articles, powerful screeners, and proprietary stock ratings that have consistently outperformed the market. Alpha Picks, their top stock-picking service, has delivered returns of over +150% since inception—making this a gift that could pay for itself with just one good idea.

📅 Hurry—these exclusive Seeking Alpha deals end July 4, 2025!

✅TrendSpider: The Ultimate Trading Edge

Unlock user-friendly, automated charting tools that make it easy to spot trends, support/resistance, and patterns—even if you’re new to technical analysis or haven’t used charts much before. I show how these features can transform your investing confidence, just as they did for me.

Access live market scans and smart watchlists to discover new trade ideas in real-time, helping you find opportunities you might otherwise miss—no advanced charting skills required. I demonstrate these features daily, making it simple for everyday investors to follow along and learn.

Learn and grow with built-in backtesting and educational resources: test strategies with decades of historical data, and join a supportive community to accelerate your charting and investing skills.

Enjoy exclusive bonuses when signing up with my link, such as custom algorithms, watchlists, and personal support—so you can start making smarter investment decisions from day one, even if you’re just getting started with charts.

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Tuesday

🪖World War 3 had no effect on the markets

World War 3 continues and yet oil goes down by a HUGE amount $SCO was the call and the market bounces back.

Trendspider CONTEST - Share with your friends

Remember to subscribe to the newsletter - for FREE - to be entered to win a year of Trendspider on July 4th.

The power of Trendspider Scans to find stocks

I was doing some scans of some stocks that have lagged the market and are an entry in the 4 hour algorithm. It came up with quite a few but here are 2 of them.

I used Relative Performance - which is NOT RSI

Here’s the scanner

Stocks found with the scanner

$LULU

$PDD - might have a nice bounce as we enter toward the July 9th Chinese tariffs agreement

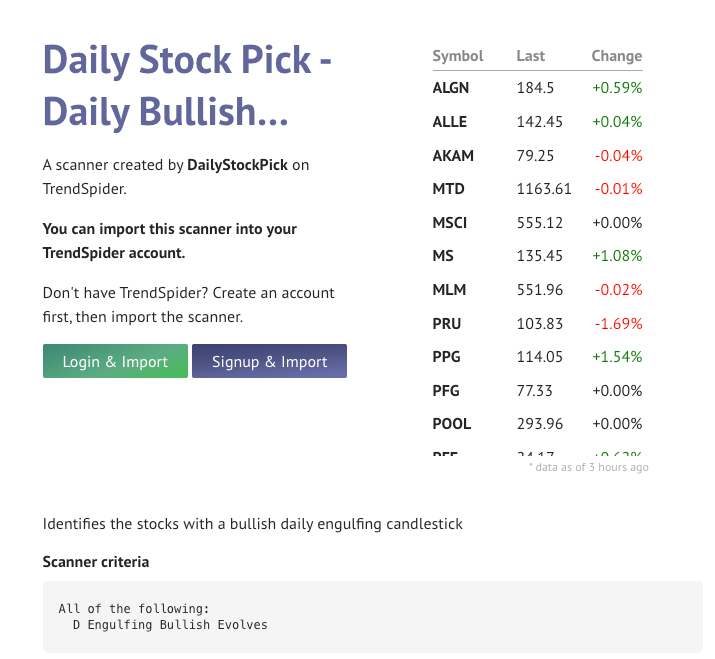

Then I did a look for bullish engulfing candles

And here’s the scanner

Stocks in the Core Portfolio

$XLK

$UBER

$RBLX

$SHOP

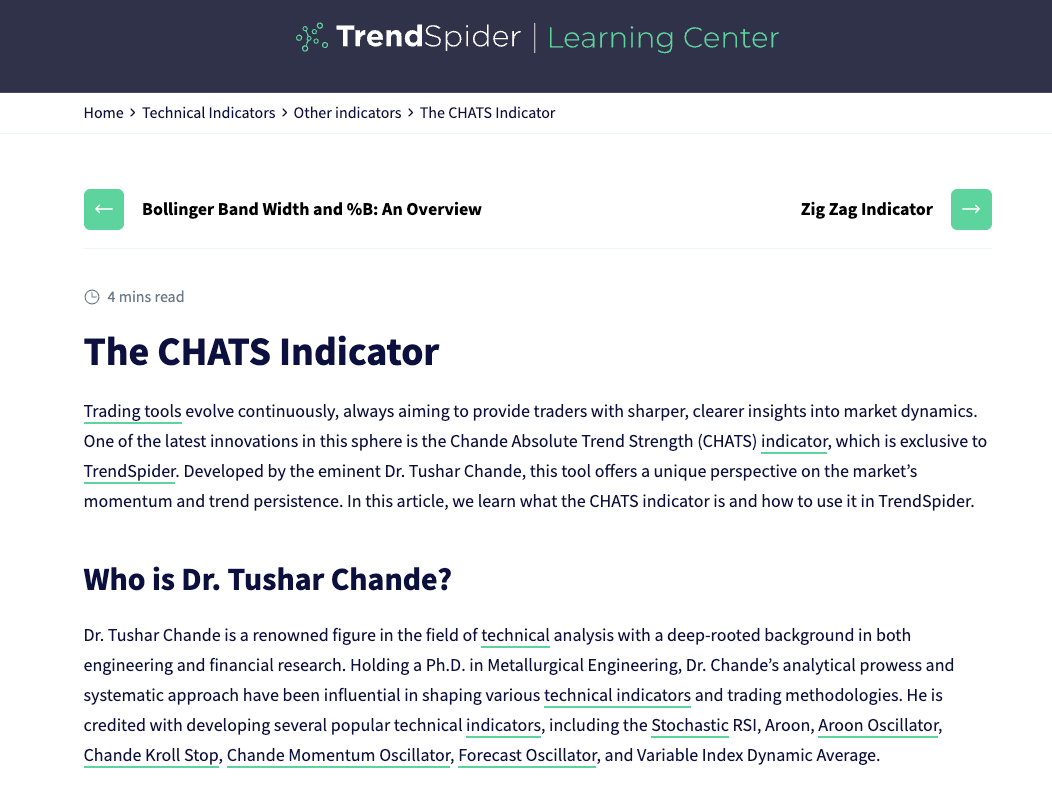

Then I did a scan to look for stocks that have flipped BULLISH in the CHATS indicator

And here’s the scanner

Stocks in the Nasdaq 100 found

$EA

$TXN

$ASML - which is buying back and retiring a lot of their stock

$MDLZ

World War 3 - things are going to change quickly

Iran fired missles - and the market went up and oil went down.

Then Trump went in to full prophet mode being the savior which backfired.

War is more than just missles - it’s Cyber attacks

One thing that won’t be reported is if Iran starts a cyber attack which is still very likely.

Cyber security stocks all went up because that might be how Iran strikes back. These are expensive but remember the last time with $crwd - these are still buy the dip

Here’s a good list of them - I own $panw $crwd $ftnt and I really like the dip in $s

Don’t forget about Tariffs

July 9th is the next tariff hurdle so what can we expect?

And then you have Fed Day late in July

Then you have July 30th with most likely a Fed rate cut as Powell speaks today and other Fed members have suggested cutting.

Let’s look at the seasonality of $qqq because last year we played $tqqq for a huge gain just on that.

Fundamentals do matter - here are some great opportunities with growth.

Does pe matter? Here’s a great chart with some great companies

1 stock that’s reporting and I like - Micron - MU 0.00%↑

One that’s interesting to $mu right now is $mu which just turned to a strong buy - has a ton of social sentiment and has semi conductor momentum

HIMS ( HIMS 0.00%↑ ) Trade idea

$hims fought back hard on $nvo … saying they were told to steer patients to wegovy regardless of patients needs … wow …

Now there might be a great one $himz - any reaction is an over reaction …

United Healthcare might be worth more ( UNH 0.00%↑ )

$unh has an offer of $325/share that $unh says under values the company. What does management know?

Software has lagged - HubSpot ( HUBS 0.00%↑ ) might be one to buy the dip on

$hubs is an interesting one that’s trading lower half of its 52 week range and a Wall Street target 40% higher - like all other software - this could be vulnerable to ai but could be traded

Tesla ( TSLA 0.00%↑ ) - Strategy in the bonus podcast today

I think there’s a clear strategy around $tsla and I’ll be doing a short bonus podcast about it today. It will be hypothetical and no real “secret” so remember - I’m no prophet.

Social Stocks and Momentum

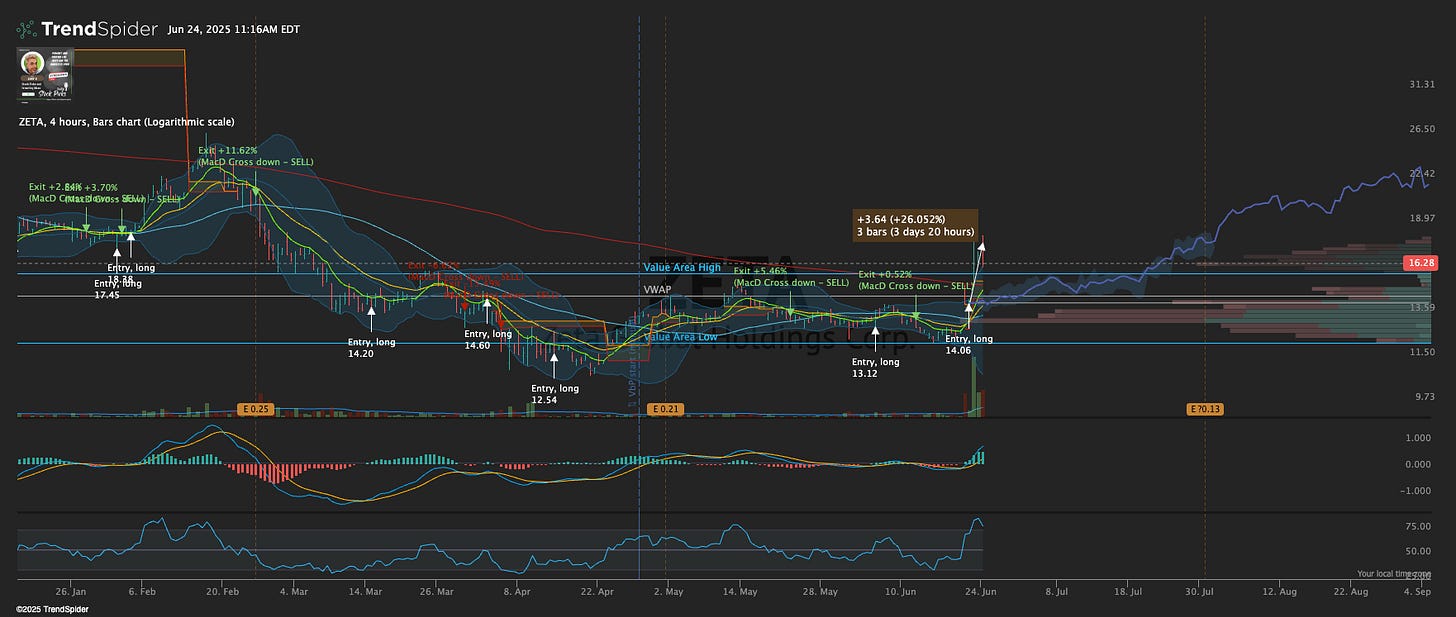

$zeta was up 20% yesterday

Todays big mover is $na

SCANS - BULLISH STOCKS WITH AN ENTRY IN THE 4 HOUR ALGORITHM IN TRENDSPIDER

COST

MSFT

PANW

SPG

XLY

BLDR

GEV

GLW

LMND

LULU

MHO

RCL

TOST

URI

UTG

AXP

CRM

HD

IBM

MMM - the 4 hour outperforms

PG

SHW

Too many to list - get the algorithm and scanner in Trendspider

Energy

SCO

UTG

Leveraged ETFs

DPST - a great triple leveraged ETF on Regional Banks that has provided great returns in the past for me.

DRN

FAS

MSFU

NAIL

Low Cost Vanguard ETFs

VNQ

SPDR Sectors

XLF

XLP

XLU

XLY

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.