My Take

Yesterday’s pop made it clear - money wants to come back in to the market. I am being patient in getting back in the market. While the Nasdaq is up 4%, I’m up 3% based on my cash position so I’m under performing which makes me feel uncomfortable being out, but I also realize as I get older, I need to be safer with my money. I’m not going to a 60/40 portfolio anytime soon, but there are 2 things I’m worried about now:

Tomorrow’s tariffs - we are seeing breaks in the Trump wall with Elon now speaking out about how dumb Navarro is and other messaging that’s not exactly as strong as before. But tomorrow is D Day and I’m not comfortable pouring back in all at once which brings me to #2.

The S&P earnings season - just do the multiple. With the S&P trading at 5200 and earnings estimates being brought down, there are issues. Take the earnings estimates being $260 (down from $280). If the multiple wants to stay on the high side of 20, you’re where you’re at. If the economy is going to be weak or volatile and the multiple or earnings wants to come down, it will go down. Do you really think with a trade war the multiple will go up or do you expect anyone to guide higher on future earnings without knowing what tariffs or uncertainty exists?

Those 2 things lead me to want to be relatively cautious, but I do have FOMO with today’s move. It reminds me of 2022 and Covid. I won’t be perfect and I’ll make mistakes, but I’m also going to be fine as will you. Leon Cooperman said it best yesterday with “be cautious”.

Trendspider - ANNOUNCING QUARTERLY PLANS SAVING UP to 40%

Try it out in Trendspider. Sign up for an annual plan and get the 4 hour algorithm and so much more! Click here for more details.

Find top Quant stocks and ETF’s to use in the 1 hour Trendspider strategy by getting Seeking Alpha Premium and a FREE 7 day trial

Get Alpha Picks - it beats the S&P

And if you want to see how I set up the portfolio, here’s the YouTube video you can watch.

Remember the Gary Bundle

The optimum bundle that I can’t live without is:

Trendspider - or some type of chart program that works for you.

Seeking Alpha Bundle that includes Premium (which is the Quant rating for thousands of stocks and the NEW Virtual Analyst Reports that make it easy to understand fundamentals ) and the Alpha Picks portfolio that is a data driven portfolio with a performance that almost triples the S&P.

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Tuesday

Expect volatility today - I would easily expect 3% to 5% moves in the indexes. Register for this Seeking Alpha Zoom meeting where a product expert will show you how to organize your Seeking Alpha Premium setup. Click the photo to register and get a FREE 7 day trial.

I won’t tell you when to buy and sell

Let’s start out with the fact that I will not be telling you when to buy and sell. This podcast was started and continues to be a way for me to research for myself. Feel free to ask me about stocks but don’t be shocked if I don’t bring them up. But I will not be giving you absolutes because the market makes you make decisions on your own.

And let’s point this out too … inverse wins

S&P Fundamentals matter - where should the market be?

4800 is about where the S&P was before the bear market of 2022 and it almost hit there. If you break below that … look out.

Fundamentally if you assume S&P earnings and the pe multiple of the S&P need to come down … you could be looking at around 3500 on the S&P which is crazy scary. I don’t think you need to rush in and patience will be key. Some stocks I sold like $avgo and $nvda came back. Some stocks I sold are still well below where I sold them.

But the White House is still messaging that not too many people own stock, that people really don’t pay attention and you add to it that if you’re pricing in a recession is too high - you’ve got downside.

What did I do yesterday? NOTHING

Full disclosure - I did nothing yesterday. I talked to a supplier of glasses because my gfs son is a major online influencer and we are designing and selling the glasses he wears, I cleaned my neighbors gutters that were clogged and then I took the dogs to get their nails clipped. I then went on spaces with a few thousand people to give them the advice I gave you yesterday. Any trade you take during this time should come with a commission to yourself where you buy $voo and you don’t sell it for 20-30 years.

It was a MESS. You had a rumor of a 90 day pause started by Kevin Hassett from the White House saying it on Fox News. The S&P show up 8% - the largest move since Covid.

Then the White House said it was fake news.

It was nuts and I still don’t get how a transcript gets screwed up like that and turns viral but that’s what it is

You’re seeing Covid style trading right now. The move in the S&P tells me that many people are defensive but can turn offensive quickly. If you weren’t trading during covid there were days when the number of cases went down - the market would RIP up! You had days when the number of cases went up and the market would rip DOWN.

This is the metric of the day and it just so happens to move the markets ALOT. It’s why you don’t want to be fully out.

Dow and S&P ended lower while Nasdaq edged up after a day of whipsawing

You should absolutely be buying for timeframe like I said yesterday

I also think this shows the 90 day pause has been discussed in the White House. But it’s clear - it’s in Trumps hands and it’s also clear how the market will react.

Be careful

But if you think it’s cut and dry … it’s not

My issue is not with the fight - it’s the implementation, gambling and messaging that’s causing undo harm to relationships and financial markets

Birthday Surprise? Mark it on your calendar

Gene Munster brought up Trump and Chi’s birthday are June 14th and 15th - he may think that date might be a CRAZY apology tour where love is shown.

But Bessent just went on tv and said the escalation with China was a mistake …. He’s either going to get fired or Trump will come out and say no it wasn’t

And Tom Lee isn’t throwing out face ripping rally calls … he’s apologizing

And I agree with this. It was in his first term when Merkel went with nordstream 2 with Russia instead of lng from the us … that made trump mad … I didn’t get it either - insiders said she didn’t trust Trump and Putin was the enemy they knew

You should know that my portfolio is quite risky ….

Remember that small caps may recover much faster - don’t miss out on small cap companies that have great fundamentals - they won’t matter in a recession but if your long term outlook - go for it

But then you have Cathie buying

So maybe utilities $exc - strong buy in the quant - has held up and isn’t stretched as far as valuation goes

$amzn wound up 2% yesterday and I still think it’s a great buy

$avgo is buying back $10b of shares … that’s huge .. it says they aren’t seeing a decrease in demand

$jnvr - up over 800% yesterday

Healthcare

Private Medicare plans are getting a huge upgrade for payments $unh $hum $cvs - remember - Biden cut those plans payments so this is a huge relief for them

Health insurers rally after CMS increases payment to Medicare Advantage plans

And did someone say a recession breakout?

Dollar Tree a 'dark horse winner in a new tariff world' - Citi Research

And the job market is about to change

China trade

I think $baba is in a good place - no tariffs and they really don’t export anything other than services …

And watch yinn and $yang - the leveraged China ETFs

And here’s the opposite one with an 80% gain

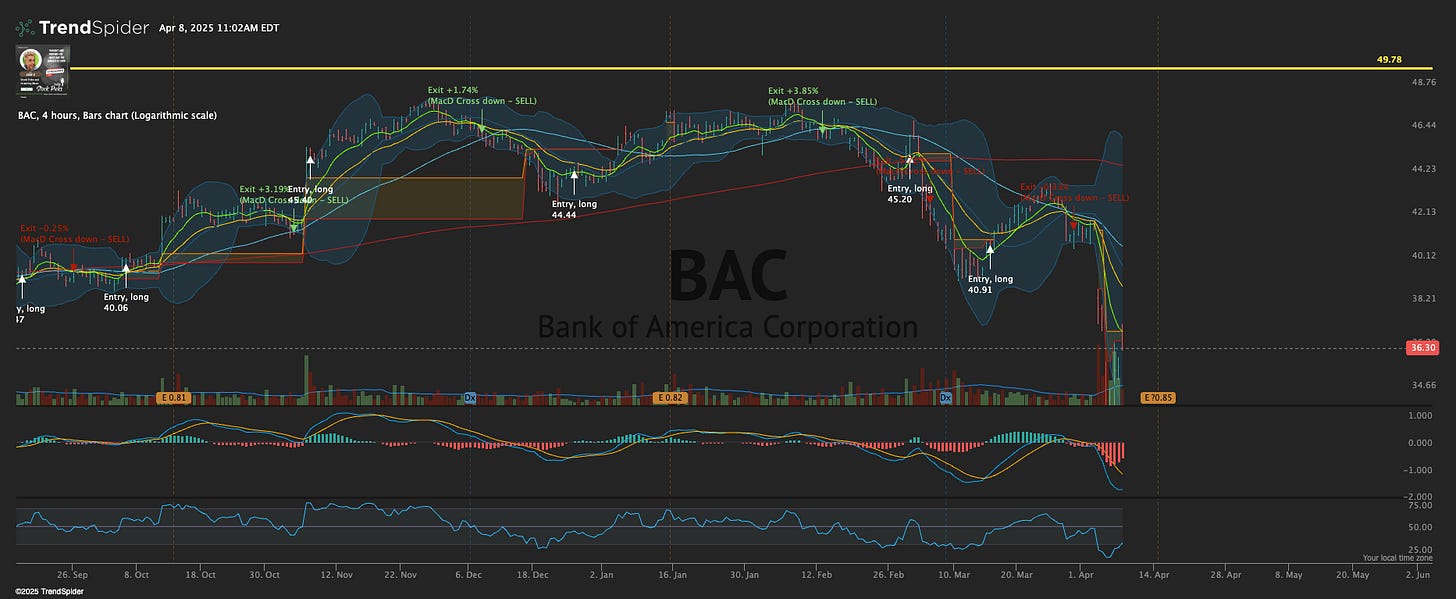

$bac is a screaming buy for the pop back to $40

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.