Technical Issues

Trendspider had a technical issue this morning that affected everyone. In my 5 years of subscribing, this is the first time this has happened and it was major. As of right now it seems most people have service restored, but they are responding on Twitter and in the CONTACT US area on the website if you can log in.

There’s literally NO better advertisement for how critical this tool is for me than to have it taken away for even a short critical time. I was PARALYZED this morning when it went down. If you’re not using the tool, find a charting tool that you look at like I look at Trendspider.

Today’s Podcast in 2 parts

With all of that said, the podcast is in 2 sections so I didn’t do an outfit change. I go over the fundamentals and things I’m seeing in the first half and then all the earnings from tonight in the second half. Plus I asked Perplexity which stock they would bet on in tonight’s earnings. NO SHOCKER HERE.

Today’s Paid Newsletter

Savings Buckets - how to save your money for Financial Independence - PAID SUBSCRIBERS

Financial Independence Savings Buckets - 3 of them and details about each one

Get the best tools that I have found to help you choose the stocks in your portfolio and find winning trades

Trendspider for LESS than $20???? YES - LIMITED TIME - TRY IT

Get a taste of what Trendspider can do. Go and watch the video on how to create your own custom indicator on the Weinstein method, test it out for 2 weeks with different strategies and see the power of this tool for LESS THAN $20.

Remember the Gary Bundle

The optimum bundle that I can’t live without is:

Trendspider - or some type of chart program that works for you.

Seeking Alpha Bundle that includes Premium (which is the Quant rating for thousands of stocks and the NEW Virtual Analyst Reports that make it easy to understand fundamentals ) and the Alpha Picks portfolio that is a data driven portfolio with a performance that almost triples the S&P.

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Steve Cress yesterday dropped some knowledge in a comment on an Alpha Picks post. I thought it was important so I’ll post it on the newsletter. It’s about volatility and his experience running a Quant fund and studying Quant analysis.

Workday ( WDAY 0.00%↑ ) - Trendspider’s find worked!

Let’s start with $wday … this was found yesterday with an engulfing candle and I highlighted it as a buy before earnings as that might be a reversal in trend ….. well they beat earnings and was up 10% after hours

Remember - it was a strong buy in the quant, a solid looking chart and software which has been strong …. Risk vs reward ….

SuperMicro ( SMCI 0.00%↑ )

And SMCI filed and shot up 13% after being down huge - they blamed Ernst and young quitting on the delayed filing … it’s interesting because it’s still not audited - this gets back to $100 now

February Weakness - seasonal

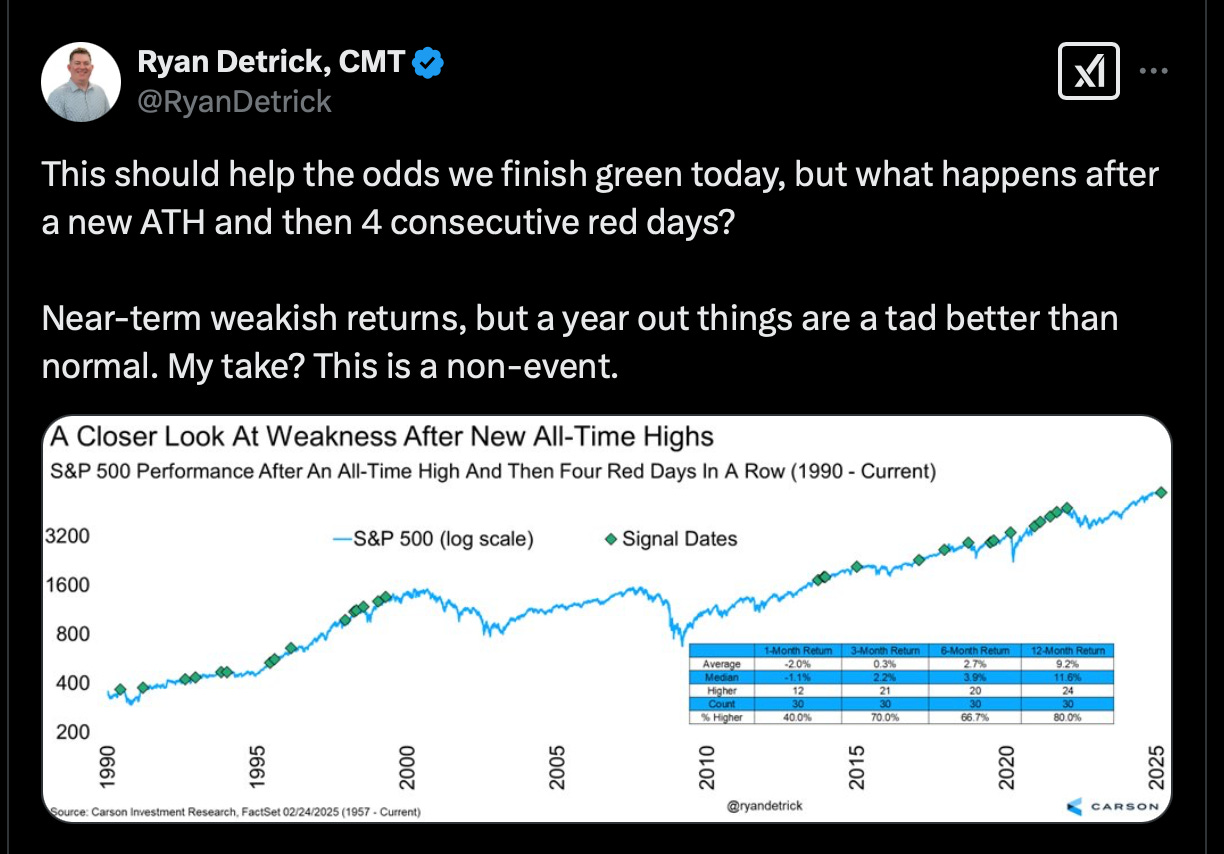

Let’s start out with this newsletter published on 2-14 - Seasonally the 2nd half of February is VERY weak, but followed by a good bull run. Is this time different? MAYBE????

And the same guy that pointed out the seasonal weakness sees this as a non event and we move higher - keep grinding and add to your winners but above all - have a strategy

And if you’re nervous is it your portfolio or your news flow???? The closer to retirement the more nervous you should be holding stocks that can lose 20% over a week or so.

10 Year Bond Rates are key - be worried about 3%

Now let’s focus on the 10 year - remember 3% would be disastrous and we are heading there

And it was based on this clip from the compound

200 Day Moving Average - LEARN IT

Many oversold stocks are approaching or under their 200 day moving average …. Use a scanner to find these as opportunities

$mags chart just looks ugly - or does it look like an opportunity under the 200 day?

Crypto - Bitcoin and Gamestop

But let’s call all degenerates … $gme buying $btc????? They are literally buying the dip

And the dip in Bitcoin was clearly signaled

Consumers are worried about the market

And the $qqq is trading below its 50 day and here are the worsr performers

Is $cost a big rebounder??

Education

A great look at Ross using vwap on a 1 minute candle and talking about risk and confirmation

Earnings

$zeta - why is it down? Guidance - notice the time of the screen shot - that’s AM - GRIND BABY!

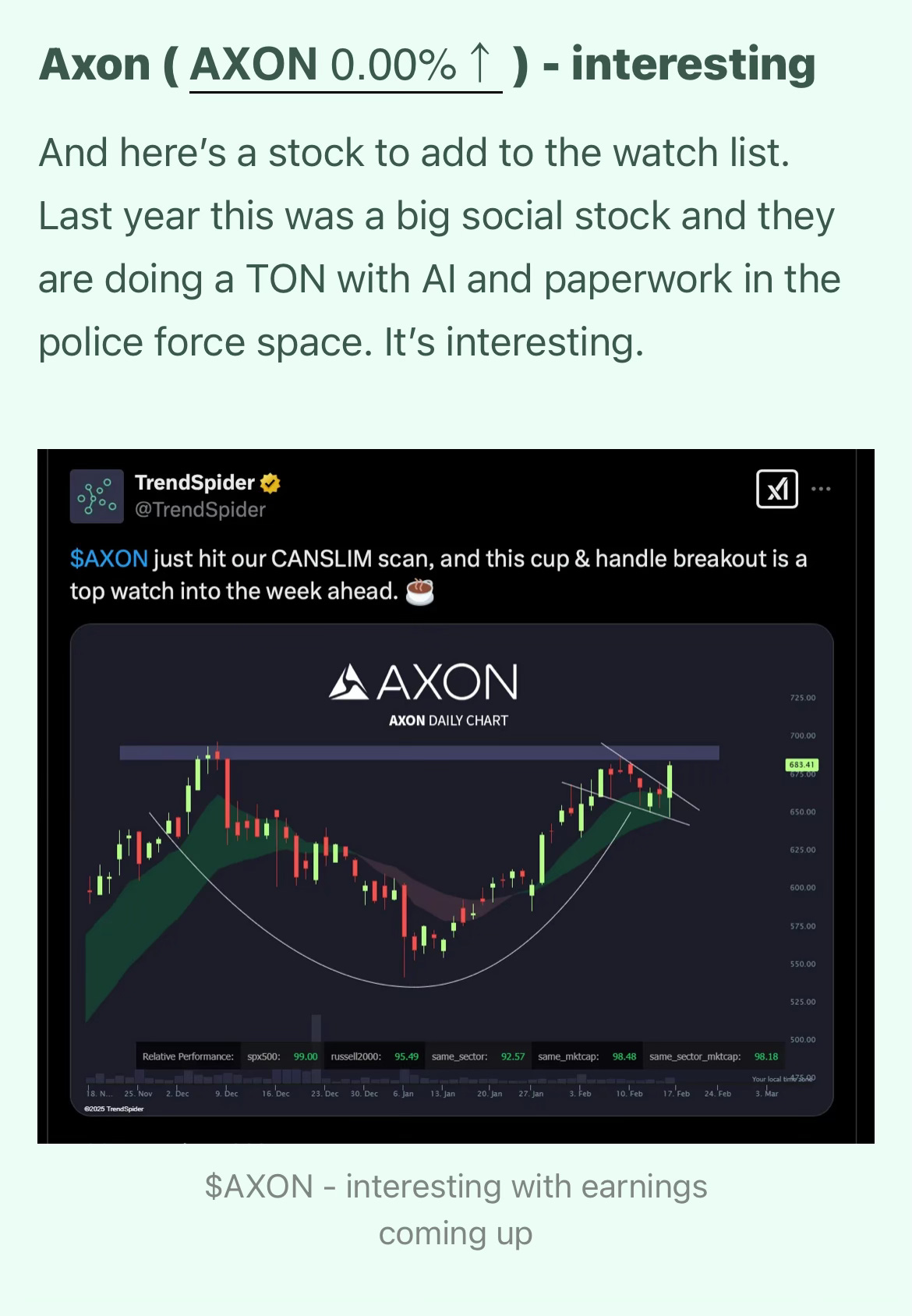

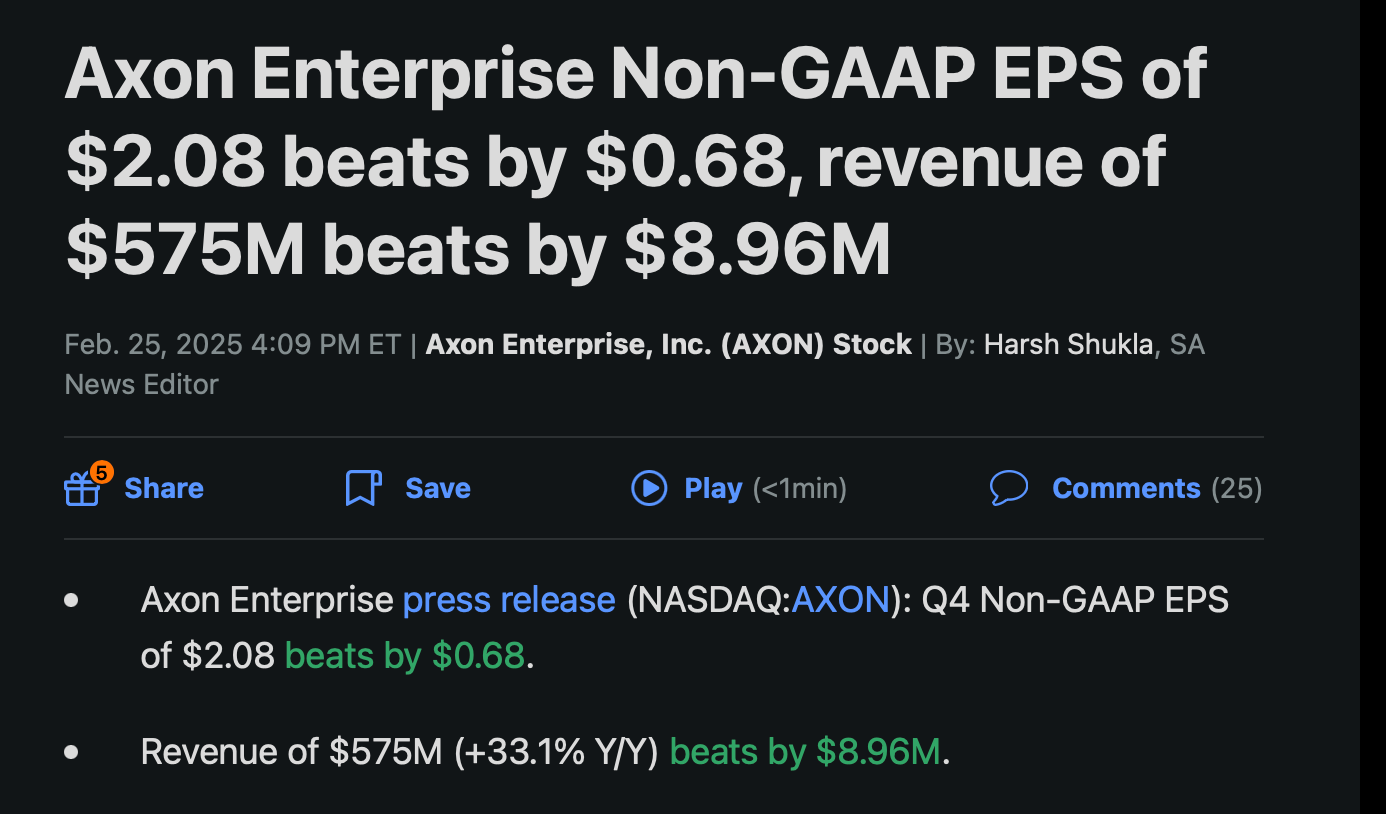

$axon killed it - paid members - I had recommended this dip - I may trade this one after these earnings to get back to all time highs

Tonight

$nvda - I expect it to be fine - it’s trading weak but any drop is going to be based on 2026 guidance imo and jenson wouldn’t be doing an hour long interview on cnbc at 7pm if things were slightly bad

$crm - expectations are high but I will own through it and look for it to get back to all time highs. Bennioff has been touting their ai product and telling stories of great use cases - he wouldn’t be doing that if they were not selling the product

$snow - lowered expectations but it’s at the top of the weekly trading range that I expect to be support at some point. If you buy or hold in to earnings it should be considered a long term holding

$ionq - expect volatility as it’s well off its high but they don’t make money.

$mara - tough with guidance on crypto being key

$pstg - one that’s moved a lot for earnings so I asked perplexity

And I will leave you with this last piece here.

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.