My Take

After I got done recording, it came out that Trump blamed Biden for the bad stock market. He blamed Biden for the GDP and Jobs numbers so it’s clear it’s not his fault at all in his mind (or at least that’s what he’s projecting). He’s also saying Tariffs would kick in, but was irate over Amazon displaying the tariff price on items purchased.

With him not owing the stock market, a trade deal that was “imminent” yesterday (still not announced), a Fed meeting that is likely not going to see the need to cut rates (even though inflation numbers came in UNDER expectation at 10am) and potential empty store shelves in May, I think you take the bounce opportunity to evaluate what stocks you want to trim. Remember - Jerome Powell is in the corner that tariffs will increase inflation so don’t expect a cool inflation number to push them to cut rates.

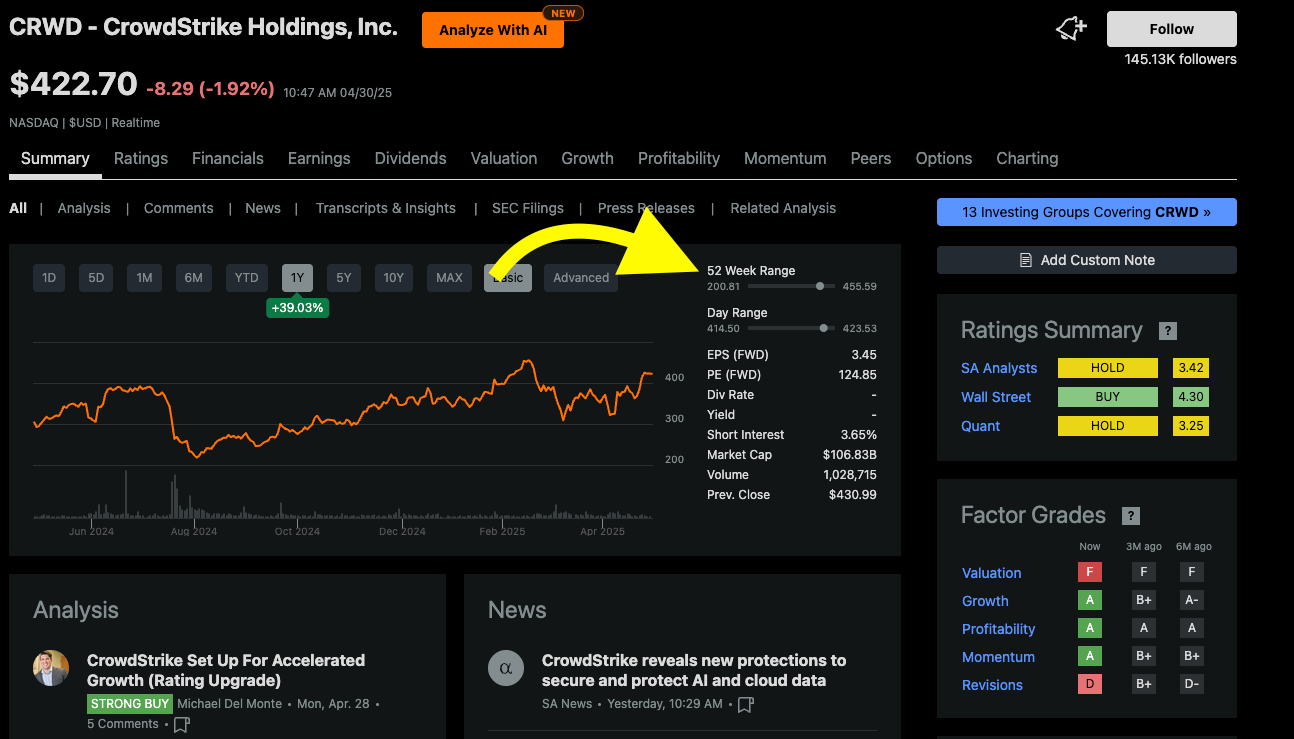

I’m not looking to sell, but taking any recent profits (Like I mentioned - Crowdstrike nearing 52 week and all time highs and I’ve got a nice gain in this stock short term, I may take some profits as it is very expensive. Make sure you’ve got an eye on your portfolio, a plan in place and full knowledge or your goals in the market. It will most likely be a very bumpy summer.

When to Sell Stocks - a collaboration with Daily Stock Pick and My Weekly Stock

This post is co-authored and a collaboration between DailyStockPick and My Weekly Stock

There are quite a few stocks up YTD in the S&P that are near 52 week or all time highs.

Seeking Alpha SPRING SALE (FREE 7 DAY TRIAL PLUS A FREE ALPHA PICK and SAVE $30 MORE)

Find top Quant stocks and ETF’s to use in the 1 hour Trendspider strategy by getting Seeking Alpha Premium and a FREE 7 day trial

Trendspider - they are changing the game of trading and investing

Try it out in Trendspider. Sign up for an annual plan and get the 4 hour algorithm and so much more! Click here for more details.

Get Alpha Picks - it beats the S&P

And if you want to see how I set up the portfolio, here’s the YouTube video you can watch.

Remember the Gary Bundle

The optimum bundle that I can’t live without is:

Trendspider - or some type of chart program that works for you.

Seeking Alpha Bundle that includes Premium (which is the Quant rating for thousands of stocks and the NEW Virtual Analyst Reports that make it easy to understand fundamentals ) and the Alpha Picks portfolio that is a data driven portfolio with a performance that almost triples the S&P.

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Wednesday

Economic Data set to come out

You’ve got a whole bunch of market moving data today from gdp to pce - expect economists to start saying how this predicts things but realize it’s all before liberation day … the adp jobs report shows a cooling job market - bad news is bad news and GDP weaker than expected - is it priced in?

It’s been 6 days of gains

6 days in a row …. Does not make a recovery but April may wind up positive

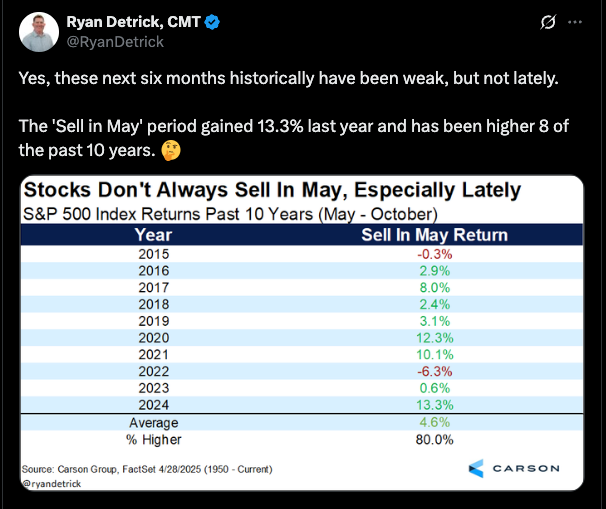

Sell in May and go away? Probably not great selling in to strength - but if you see weakness in the summer, those pullbacks the last few years have been violent as there have not been buyers

Tariffs - no deals

Tariff updates / still no deal announced like lutnick said yesterday

Sector in Focus

Don’t forget about sectors - $xlk is my top sector etf I own personally but there are quite a few

Biggest movers

Some Stocks

$eat had amazing earnings and this was all profit taking …. Buy the dip on this alpha pick… I think that’s the way I’m going to do alpha picks … add to the winners and cut the losers … I just haven’t figured out the strategy

$okta - Weinstein stage 2 ? YES IT IS

What does that mean? Go look to sign up for Trendspider after reading this article explaining it.

I loved a space I saw with John fort of cnbc last night the ceo of $frsh - this should be on your watch list

$smci pre announced and we can’t see whether this is just smci or if it’s all of ai … it was a preannouncement that took the company down 20% based on customers pushing out buys to later dates. does it mean $nvda is going to be bad? What about $dell … its all uncertain and semiconductors are cyclical meaning its clearly a cycle or “order a ton” and then “let’s delay”

And that caused a bunch of “warnings”

$meta - I like this move - again … it’s about eyeballs and usage … as an assistant on your phone that’s better than Siri … they may take some share

Here are 7 stocks with a peg ratio under 1

$wfc - this is crazy … it’s 18% of their market cap if they retire the stock

$crwd is near all time highs again - time to trim when you get a signal - whatever your strategy is

I got asked about an energy stock - and I don’t do much energy investing - but when I do - it’s $mplx - look at that dividend

Earnings

$sbux - I would not bet against the ceo … he’s got a track record of turning things around … simplifying the menu and changing things has been what he did so keep an eye on this one

$grab reported overnight… what’s funny is the quant rating has this higher than $uber - it’s growing more

Tonight

$meta and $msft tonight …. $meta down most likely on the $snap earnings … I would not expect a huge beat but there most likely will need to be some guidance on Chinese advertising from Temu and other cheap things

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.