My Take

I’ve been saying I’m cautious in this market and stocks continue to outperform on earnings. I am using the new Perplexity Comet browser so I went and asked AI about the PE in the market. You can see it’s extended.

You’re going to have decisions to make about seasonality, earnings and other factors in the market. Nobody is going to tell you “here’s the top” and you’re more than likely NEVER going to time things perfectly. With the PE being high, earnings and guidance will have to go up because it’s not likely the PE is going to go up. That paints the picture for larger companies (like the Mag 7) needing to grow earnings and guide higher. Smaller cap names have been doing just that so far along with GOOG 0.00%↑ and others last week. That’s why this week is key. 33% of the S&P is reporting this week representing between 40% and 50% of the market cap. That’s a message about how the economy is going.

The Tools I use - All on Sale - GET THEM NOW - Some with FREE 7 day trials!

Trendspider - SAVE WITH MY LINK - Try it for 14 days with the discounted Trial or get the annual plan to get my 4 hour algorithm.

BTW - even your 14 day trial will come with an introductory 1-1 training session.

Seeking Alpha Bundle - includes both Premium and Alpha Picks -

Seeking Alpha Premium - Get the Quant rating, Top stocks, AI analyst reports and more.

Alpha Picks - the no brainer portfolio with full analysis of each pick

Spotify, Apple and YouTube Links

Spotify

Apple

YouTube

Pod Notes

Tuesday

🎩 Is this the top?

Wanna know what makes the top of the market? Cramer as always

And blind luck turns to “I’m a genius” usually at the top

🤖 Ai Tools - learn to use them -

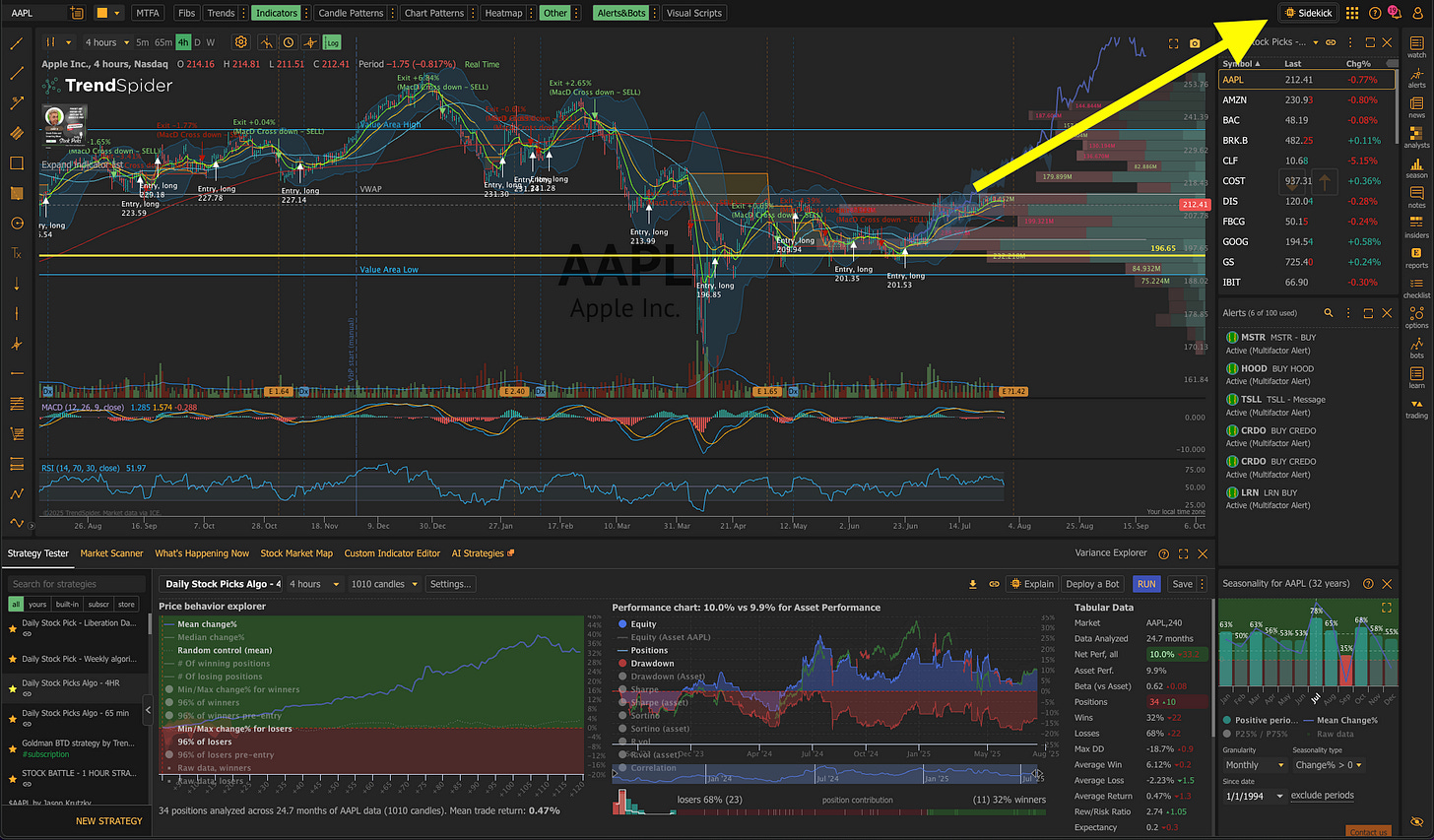

I wrote a newsletter this weekend about using Perplexity as a stock picking tool. NOW - Trendspider announced they are going to launch Sidekick to all subscribers starting in a few weeks. It’s not official, but I was playing with it yesterday. Here are 3 things I did:

Looked at an optimal strategy for a rebound in TGT 0.00%↑ - it gave me ideas

I asked if it was a good time to buy CRDO 0.00%↑ based on my 4 hour algorithm

I asked if it was a good time to buy UNH 0.00%↑ before earnings and to suggest a strategy for me based on the last 10 years of data

If you’re not a subscriber - I’ll get an official launch date and consider subscribing for the 2 week trial and if you are a subscriber - start making a list of things you would ask it or if you see it in the upper right hand corner of your screen - START USING IT TODAY!

📈 Portfolio Analysis using Perplexity

And then I got Perplexity’s Comet browser to install which I’m using right now. Again - AI is changing investing - you can change with it or stick to what you’re doing. None of these things are going to guarantee you success just like college doesn’t guarantee you success in life - it just gives you an edge up on the competition and helps give you as much information as possible to make the best possible decision.

BTW - I used perplexity to do a full portfolio analysis. I won’t share that, but I may share the steps and prompts I used. It was definitely eye opening for me so I suggest you set some time aside to do that.

💉 GLP-1 - It’s a Lilly Market

NVO 0.00%↑ - this is a disaster - but new management now? MAYBE - LLY 0.00%↑ was the clear winner here

What’s my Secret Weapon? THE SEEKING ALPHA QUANT

Seeking Alpha Quant is my secret weapon

🏛️ Some Winners

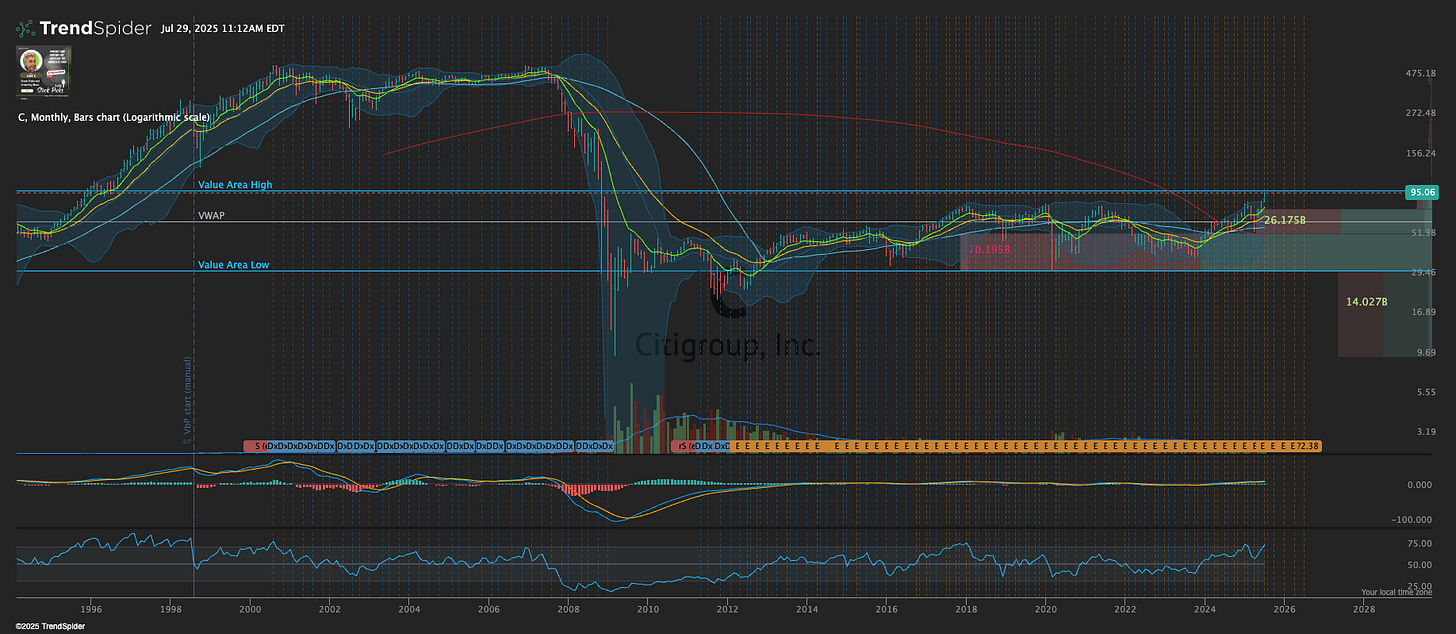

C 0.00%↑ is up 11% over 1 month - book value is $106 that I’ve been saying since $40. I don’t own this one right now - I own GS 0.00%↑ BAC 0.00%↑ WFC 0.00%↑

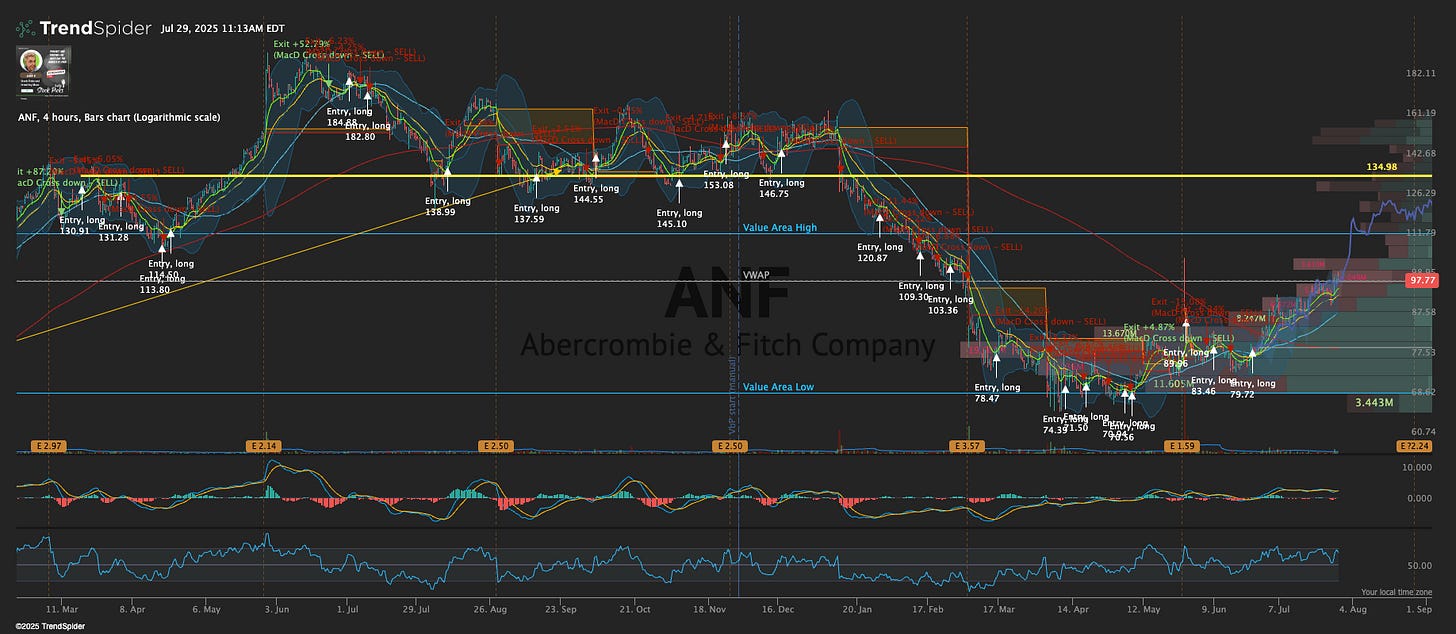

Old and forgotten former alpha pick ANF 0.00%↑ - up 6% I asked perplexity

BMNR 0.00%↑ - remember … that is Tom Lee

I also asked it why BMNR 0.00%↑ went down … it was down 11% during the day yesterday and down 15% after hours

And then they announce a buy back - CRAZY

Autonomous cars will be a boost to the bottom line on these 3 stocks. I own all 3.

TSLA 0.00%↑ is moving forward with their vision only plan - you need to believe in this and it’s not science fiction

Is this a good risk / reward for a catchup trade on a trend line? TGT 0.00%↑

The short term trend is up with a golden cross and the 50 day turning positive - where did the red trend line come from?

SMCI 0.00%↑ s up 10% yesterday - this was after the podcast

VAPE 0.00%↑ was up 548% - why?

👑The king of yield - 60% dividend yield paid weekly? Is YMAX 0.00%↑ worth it?

Let’s look at one of the Huge Yielding ETF’s that pays off weekly.

The 4 hour algorithm got you in April 11th at $12.20 - it just got you out at $13.89 - that’s a 13% gain.

During this time it also paid you $2.56 in dividends - that’s 21% over that short time. So you made a total of 34% over that time. Sounds great.

Let’s look at it from Jan 3rd where it got you in at $17.45 - soy you held to the bottom April 8 at $11.50. that’s a 34% loss.

During that time you got $2.34 in dividends - that’s 13% - so you only lost 21%.

The point - you will see swings and whether it works out or not for your goals is your choice. It doesn’t fit my goals so if you’re going to ask me if I like this one - I don’t own it, but someone may need weekly income and they are okay with it. Go and do the math - you don’t know what it’s going to trade like, you don’t know the share price, you don’t know the dividends. In comparison if you bought $10k of US treasury bonds at 4% - for 10 years you’ll have the same income and at the end of the 10 years, you’ll have $10k.

So whether I like it or not is not an issue - whether it fits your goals is the issue. So rather than asking me if I like it - go and do the math - the risk is your own - not mine.

Now there’s a new one - staking with Solana … $ssk - this interests me but I’m going to do my research and I’m going to use ai … if you’re interested I suggest you do the same thing

Earnings

Boeing - BA 0.00%↑ is doing amazing now - year over year it looks fantastic - this is absolutely a company that’s moving back toward positive cash flow and profitability. This probably should go back in to the core portfolio. They have slashed the losses and now it’s at a new 52 week high and now a doubling from the lows. The trend has changed. Remember - there are only 2 companies in the world that make planes and they have a defense line of business that’s entrenched so it’s mostly about management and that has changed back to an engineer who’s in charge instead of a bean counter.

Celestica - CLS 0.00%↑ - a big holding of mine - a top 2025 stock and an alpha pick portfolio stock - killed it and was up 10% to all time highs

Btw … paid newsletter subs got GLW 0.00%↑ as a pick back in January as one I thought was going to kill it this year. My theory is- $glw makes the glass for fiber connections …. Guess what connects data centers? It has doubled the S&P ytd - I would say I got that right.

Just for shits and giggles - paid subs also got my look at TLN 0.00%↑ - up 78% ytd … I found this on seeking alpha because $vst was last years darling and this had not moved the same

I’m no Steve cress but the newsletter is the budget Steve cress based on the price 😂😂

SOFI 0.00%↑ - taking off

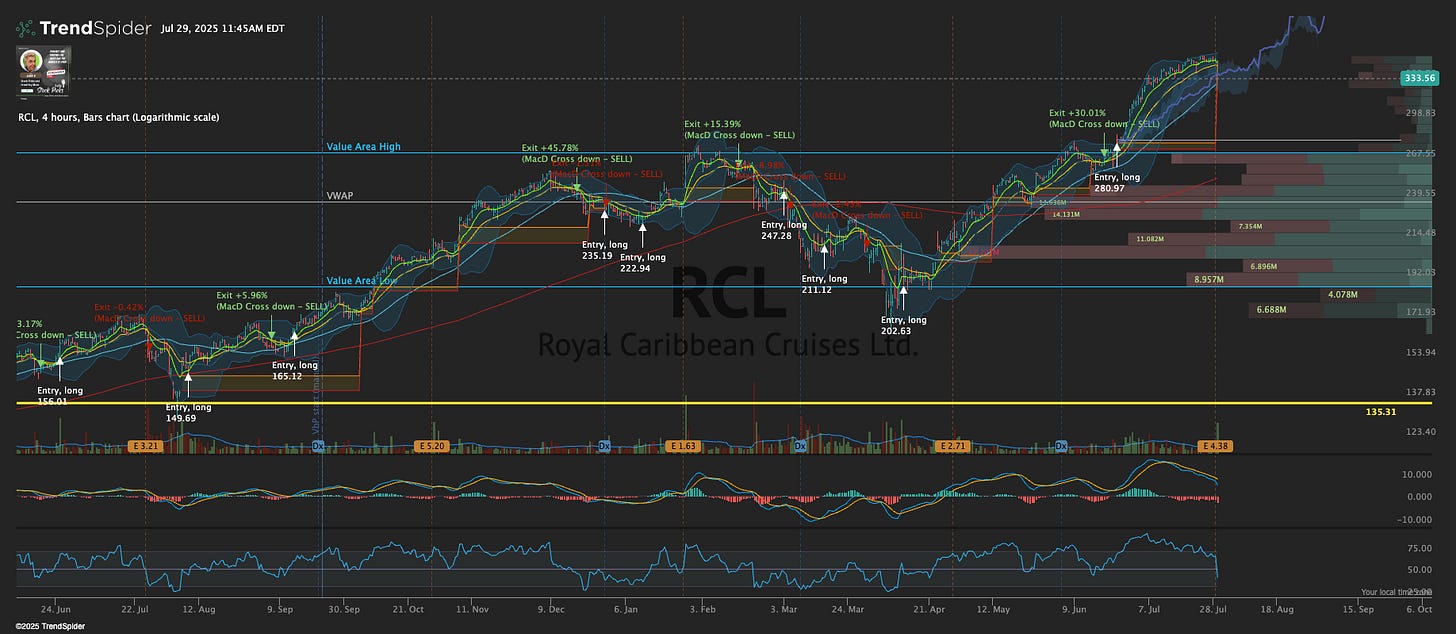

Unlike CCL 0.00%↑ - RCL 0.00%↑ didn’t do well on earnings.

SCANS - Bullish stocks in the 4 hour algorithm

Leveraged ETFs

Listen to this episode with a 7-day free trial

Subscribe to DailyStockPick’s Newsletter to listen to this post and get 7 days of free access to the full post archives.